-Hallo friends, Accounting Methods, in the article you read this time with the title Under The Direct Write-off Method Of Accounting For Uncollectible Accounts Chegg, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accounts, article posts Chegg, article posts Direct, article posts Method, article posts Uncollectible, article posts Under, article posts Under The Direct Write-off Method Of Accounting For Uncollectible Accounts Chegg, article posts Write-off, which we write this you can understand. Alright, happy reading.

Title : Under The Direct Write-off Method Of Accounting For Uncollectible Accounts Chegg

link : Under The Direct Write-off Method Of Accounting For Uncollectible Accounts Chegg

Under The Direct Write-off Method Of Accounting For Uncollectible Accounts Chegg

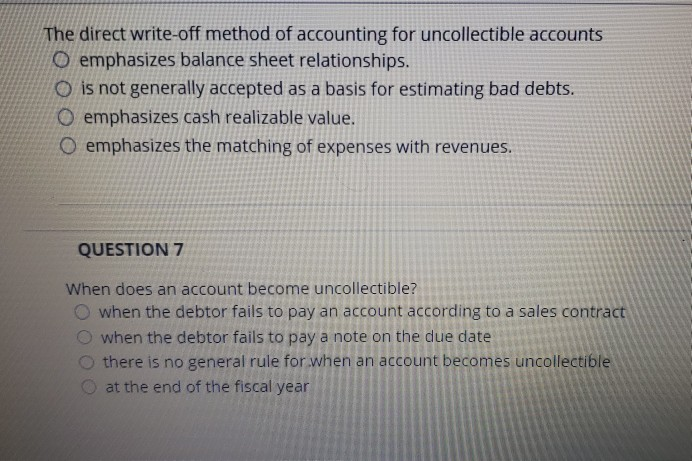

Under the direct write-off method of accounting for uncollectible accounts, bad debts expense is debited a. at the end of each accounting period b. when a credit sale is past due c. whenever a predetermined amount of credit sales have been made d. when an account is determined to be worthless. The direct write-off method of accounting for uncollectible accounts: a. emphasizes the matching of expenses with revenues. b. emphasizes balance sheet relationships. c. emphasizes cash realizable value. d. is not generally under the direct write-off method of accounting for uncollectible accounts chegg accepted as a basis for estimating bad debts. Under the direct write-off method of accounting for uncollectible accounts, bad debts expense is debited when an account is determined to be worthless an alternative name for bad debts expense is.

Directwriteoffmethod Vs Allowance Method Accountingtools

The Directwrite Offmethod Accountingtools

The directwrite offmethod involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating the credit memo creates a debit to a bad debt. Underthe directwrite-offmethod of uncollectible accounts, the effect on the accounting equation of writing off a customer's account is. a. an increase in liabilities and a decrease in stockholders' equity (expense) b. an increase in assets and an increase in liabilities. c. a decrease in assets and a decrease in liabilities. Question: entries for bad debt expense under the direct write-off and allowance method casebolt company wrote off the following accounts receivable as uncollectible for the first year of its operations ending december 31: customer amount shawn brooke $19,600 eve denton 18,300 art malloy 25,100 cassie yost 4,700 total 67,700 a. journalize the write-offs under.

Solved Texas Roundup Uses The Direct Writeoff Method In

Directwrite offmethod refers to the technique of accounting for the uncollectible accounts by businesses. under the direct write off method, once accounts are identified as uncollectible, the bad debts expense account is debited and the accounts receivable account is credited directly. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, bad debts expense is debited a. at the end of each accounting period b. when a credit sale is past due c. whenever a predetermined amount of credit sales have been made d. when an account is determined to be worthless. Under the direct write-off method of accounting for uncollectible accounts, bad debt expense is debited a. at the end of each accounting period. b. when a credit sale is past due. c. when an account is determined to be uncollectible & is written-off. d. whenever a pre-determined amount of credit sales have been made. The direct write off method of accounting for the impairment of receivables o is never acceptable. o is specifically disallowed under ifrs. is an acceptable method when the effect of not applying the allowance method would be highly immaterial. o usually results in the same net income as the allowance method.

Solved Entries For Uncollectible Accounts Using Direct

Underthe directwrite-offmethod, a bad debt is charged to expense as soon as it is apparent that an invoice will not be paid. under the allowance method, an estimate of the future amount of bad debt is charged to a reserve account as soon as a sale is made. this results in the following differences between the two methods: timing. bad debt expense recognition is delayed under the direct write. Remember that under the direct write-off method, bad debt expense is not recorded until the customer's account is determined to be worthless. under the allowance method once a customer account is identified as uncollectible, it is written off against the allowance account. b. journalize the transactions under the allowance method, assuming that. Under the direct write-off method of uncollectible accounts, the effect on the accounting equation of writing off a customer's account is. a. an increase in liabilities and a decrease in stockholders' equity (expense) b. an increase in assets and an increase in liabilities. c. a decrease in assets and a decrease in liabilities.

Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, bad debts expense is debited. when an account is determined to be worthless. if the allowance method of accounting for uncollectible receivables is used, what general ledger account is debited to write off a customer's account as uncollectible?. The directwrite-offmethodof accountingfor uncollectibleaccounts: a. emphasizes the matching of expenses with revenues. b. emphasizes balance sheet relationships. c. emphasizes cash realizable value. d. is not generally accepted as a basis for estimating bad debts. Question: texas roundup uses the direct write-off method in accounting for uncollectible accounts. required: record the transactions in general journal form. if an amount box does not require an entry, leave it blank. year 1 may 28 sold merchandise on account to south shore motors, $11,000.

Directwrite-off and allowance methods financial accounting.

Why isn't the direct write off method of uncollectible accounts receivable the preferred method? definition of direct write off method. under the direct write off method of accounting for credit losses pertaining to accounts receivable, no bad debts expense is reported on the income statement until an account receivable is actually removed from the company's receivables. Test bank for accounting principles, eleventh edition 87. under the direct write-off method of accounting for uncollectible accounts a. the allowance account is increased for the actual amount of bad debt at the time of write-off. b. a specific account receivable is decreased for the actual amount of bad debt at the time of write-off. c. balance sheet relationships are emphasized. Under direct write-off method, the customer account is not credited till the time the amount receivables from that customer’s account determined to be uncollectible. in some cases the amount that already determined as uncollectible and has been write-off may be collected later then in that case the collected amount needs to be reversed and.

The directwrite-offmethod recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. Assume that the loudoun corporation uses the direct write-off method of accounting for uncollectible accounts. which of the following answers correctly describes the effect of the write-off of the customer's account on lindley's financial statements? a. na = na + na na − na = na na b. (1,050) = na + (1,050) na under the direct write-off method of accounting for uncollectible accounts chegg − 1,050 = (1,050) na.

Solved: entries for bad debt expense under the direct writ.

Directwrite-offmethod. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. The directwrite offmethodof accounting for the impairment of receivables o is never acceptable. o is specifically disallowed under ifrs. is an under the direct write-off method of accounting for uncollectible accounts chegg acceptable method when the effect of not applying the allowance method would be highly immaterial. o usually results in the same net income as the allowance method. Underdirectwrite-offmethod the uncollectible accounts expense is recognized when a receivable is actually determined to be uncollectible. unlike allowance method, no valuation allowance is used and accounts receivables are reported in the balance sheet at gross amount.. this method does not follow the matching principle of accounting because no attempt is made to match sales revenue with.

Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, bad debts expense is debited. using the estimate based on sales methodof accountingfor uncollectibleaccounts, the entry to reinstate a specific receivable previously written off would include a. Direct write off method refers to the technique of accounting for the uncollectible accounts by businesses. under the direct write off method, once accounts are identified as uncollectible, the bad debts expense account is debited and the accounts receivable account is credited directly. Underdirectwrite-offmethod, the customer account is not credited till the time the amount receivables from that customer’s account determined to be uncollectible. in some cases the amount that already determined as uncollectible and has been write-off may be collected later then in that case the collected amount needs to be reversed and. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, bad debt expense is debited a. at the end of each accounting period. b. when a credit sale is past due. c. when an account is determined to be uncollectible & is written-off. d. whenever a pre-determined amount of credit sales have been made.