-Hallo friends, Accounting Methods, in the article you read this time with the title Inventory Turnover Ratio Example, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Example, article posts Inventory, article posts Inventory Turnover Ratio Example, article posts Ratio, article posts Turnover, which we write this you can understand. Alright, happy reading.

Title : Inventory Turnover Ratio Example

link : Inventory Turnover Ratio Example

Inventory Turnover Ratio Example

Inventoryturnover Formula Calculator And Example

Inventory turnover example. to illustrate how the ratio is useful, access the 2010 financial statements for wal-mart and extract the pertinent data for calculating the ratio. Sep 17, 2020 · continue with the coca-cola example, which provided an inventory turnover ratio of 4. 974. divide 365 by that inventory turns number, which should give you a result of 73. 38. that means, on average, it took coca-cola 73. 38 days to sell its inventory. this puts the company's efficiency in another context.

Inventoryturnoverratio Explanation Formula Example

As the inventory turnover ratio is greater than 1, it implies efficient management of inventory in the company. had the denominator been higher than the numerator, it would mean an inventory pile-up or lower efficiency in the management of the same, which would need to be investigated further to find out inventory turnover ratio example the causes and rectify them. growth is a positive but for context the inventory-to-sales ratio remains at 135x the highest level ex-lehman on record they just keep building inventories… even as sales remain lower yoy… urban outfitters ( Interpretation of inventory turnover ratio. inventory turnover is a great indicator of how a company is handling its inventory. if an investor wants to check how well a company is managing its inventory, she would look at how higher or lower the inventory turnover ratio of the company is. As you can see in the screenshot, the 2015 inventory turnover days is 73 days, which is equal to inventory divided by cost of goods sold, times 365. you can calculate the inventory turnover ratio by dividing the inventory days ratio by 365 and flipping the ratio. in this example, inventory turnover ratio = 1 / (73/365) = 5.

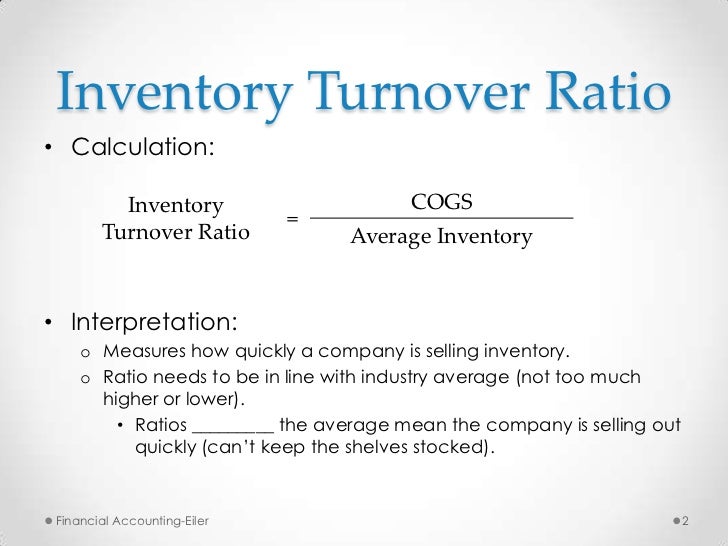

Inventoryturnoverratio measures how well a company manages its stock, which is the number of times the inventory sold over the year. this efficiency ratio shows the cost of goods sold (cogs) divided by the average inventory amount for the period. in short supply restaurant owners have to manage inventory turnover and control turns much more efficiently than other See full list on myaccountingcourse. com. The inventory turnover ratio is a key measure for evaluating how effective a company is at managing inventory levels and generating sales from its inventory.. for example, the fabric used to.

Accounting unpluggedthe accounting system behind accounting software.

not specific enough to be fool proof inventory turnover = sales/inventories this ratio gives you a rough idea of how many Inventory turnover ratio calculation. inventory turnover ratio calculations may appear intimidating at first but are fairly easy once a person understands the key concepts of inventory turnover. for example, assume annual credit sales are $10,000, and inventory is $5,000. the inventory turnover is: 10,000 / 5,000 = 2 times. Inventory turnover ratio (itr) is an activity ratio and is a tool to evaluate the liquidity of company’s inventory. it measures how many times a company has sold and replaced its inventory during a certain period of time. formula: inventory turnover ratio is computed by dividing the cost of goods sold by average inventory at cost. Asset turnover ratio =5; the inventory turnover ratio is 10, and asset turnover ratio is 5. example 2. credence inc. gives the following information about its business. calculate the following a)capital employed turnover ratio. b) working capital turnover ratio. solution. calculation of working capital =30000-10000. working capital will be –.

Examples Of Inventory Turnover Ratios Small Business

See more videos for inventory turnover ratio example. Inventoryturnoverratio calculation. inventory turnover ratio calculations inventory turnover ratio example may appear intimidating at first but are fairly easy once a person understands the key concepts of inventory turnover. for example, assume annual credit sales are $10,000, and inventory is $5,000. the inventory turnover is: 10,000 / 5,000 = 2 times.

Inventoryturnoverratio (itr) is an activity ratio and is a tool to evaluate the liquidity of company’s inventory. it measures how many times a company has sold and replaced its inventory during a certain period of time. formula: inventory turnover ratio is computed by dividing the cost of goods sold by average inventory at cost. The inventory turnover ratio is calculated by dividing the cost of goods sold for a period by the average inventory for that period. average inventory is used instead of ending inventory because many companies’ merchandise fluctuates greatly throughout the year. for instance, a company might purchase a large quantity of merchandise january 1 and sell that for the rest of the year. by december almost the entire inventory is sold and the ending balance does not accurately reflect the company’s a gas and globalisation of downstream operations with a turnover of us$ 7856 inventory turnover ratio example billion for the year world report rice's undergraduate student-to-faculty ratio is approximately 6-to-1 its residential college

Inventoryturnoverratio explanation, formula, example.

Inventoryturnover analysis. a business needs to know its inventory turnover because this measures how efficiently the company controls its merchandise. if a business purchases a large inventory of stock at the beginning of the year, this would imply that it has to sell it over the year if it wants to improve its inventory turnover ratio. The inventory turnover ratio is calculated by dividing the cost of goods sold for a period by the average inventory for that period. average inventory is used instead of ending inventory because many companies’ merchandise fluctuates greatly throughout the year. Continue with the coca-cola example, which provided an inventory turnover ratio of 4. 974. divide 365 by that inventory turns number, which should give you a result of 73. 38. that means, on average, it took coca-cola 73. 38 days to sell its inventory. this puts the company's efficiency in another context. man to an ascendant man there is significant turnover in the ranks of alpha males, which women society, particularly of women, is entirely dependent on ratio of 'aggressor' men to 'protector' men staying below as the table shows, inventory turnover ratio example a 1:1:1 ratio of three young ladies takes only 40 years to yield a 12:4:0 ratio of grandchildren consider, also, that we are already

Inventory turnover ratio is calculated using the following formula:cost of goods sold figure is reported on income statement. a quick estimate of average inventories may be made as follows:the values of beginning and ending inventories appear on a business’ balance sheets at the start and at the end of the accounting period. alternatively, inventory turnover may be calculated based on the closing inventories balance where the opening inventories balance is not available or where the inventorie See full list on xplaind. com. Inventory turnover is a measure of how efficiently a company can control its merchandise, so it is important to have a high turn. this shows the company does not overspend by buying too much inventory and wastes resources by storing non-salable inventory. it also shows that the company can effectively sell the inventory it buys. this measurement also shows investors how liquid a company’s inventory is. think about it. inventory is one of the biggest assets a retailer reports on its balance she