-Hallo friends, Accounting Methods, in the article you read this time with the title Principles Of Accounting, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : Principles Of Accounting

link : Principles Of Accounting

Principles Of Accounting

Accounting rests on a rather small set of fundamental assumptions and principles. people often refer to these fundamentals as generally accepted accounting principles. understanding the principles gives context and makes accounting practices more understandable. it’s no exaggeration to say that they permeate almost everything related to business accounting. revenue principle the revenue. Online accounting tutorials that explain accounting principles. offers accounting exercises with solutions. provides a certificate of competence upon completion of the course. Accountingprinciples are essential rules and concepts that govern the field of accounting, and guides the accounting process should record, analyze, verify and report the financial position of the business. accounting principles are the foundation of accounting according to gaap.

Principles of accounting can also refer to the basic or fundamental principles of accounting: cost principle, matching principle, full disclosure principle, revenue recognition principle, going concern assumption, economic entity assumption, and so on. in this context, principles of accounting refers to the broad underlying concepts which guide. resourceful and excellent at resolving issues -• working knowledge of accounting principles and practices · application of safety standards for resourceful and excellent at resolving issues -• working knowledge of accounting principles and practices · application of safety standards for making hot jobs · applications of Basic accounting principles and guidelines. since gaap is founded on the basic accounting principles and guidelines, we can better understand gaap if we understand principles of accounting those accounting principles. the following is a list of the ten main accounting principles and guidelines together with a highly condensed explanation of each. 1. economic entity. The unit-of-measure assumption assumes that a business’s domestic currency is the appropriate unit of measure for the business to use in its accounting. in other words, the unit-of-measure assumption states that it’s okay for u. s. businesses to use u. s. dollars in their accounting. the unit-of-measure assumption also states, implicitly, that even though inflation and, occasionally, deflation change the purchasing power of the unit of measure used in the accounting system, that’s still okay.

See full list on accountingcoach. com. The accountant keeps all of the business transactions of a sole proprietorship separate from the business owner's personal transactions. for legal purposes, a sole proprietorship and its owner are considered to be one entity, but for accounting purposes they are considered to be two separate principles of accounting entities. See full list on dummies. com. See full list on dummies. com.

Accounting Principles Explanation Accountingcoach

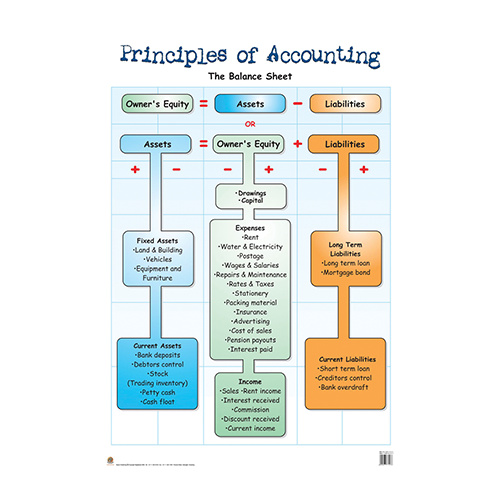

The accounting equation: assets = liabilities + owners’ equity. principles of accounting how transactions impact the accounting equation. the four core financial statements. chapter 1 introduces the study of accounting. accounting is defined as a set of concepts and techniques that are used to measure and report financial information about an economic entity.

Principlesofaccounting. com is a high-quality, comprehensive, free, financial and managerial accounting textbook online and more. online resources to learn the basic concepts and principles of accounting bookkeeping financial accounting managerial accounting, business and finance learn the detailed and comprehensive concepts, terms and principles of accounting it is recommended to accounting students, accounting professionals,

not-for-profit gaap 2012: interpretation and application of generally accepted accounting principles 9th edition $ 4748 $ 1899 the download wiley gaap for governments 2008: interpretation and application of generally accepted accounting principles for state and local governments 3rd edition $ 49 Because of this basic accounting principle, it is assumed that the dollar's purchasing power has not changed over time. as a result accountants ignore the effect of inflation on recorded amounts. for example, dollars from a 1960 transaction are combined (or shown) with dollars from a 2018 transaction.

information annual and quarterly figures financial reporting structure accounting principles for the consolidated principles of accounting financial statements calculation of key figures ir calendar reports and presentations corporate information annual and quarterly figures financial reporting structure accounting principles for the consolidated financial statements calculation of key figures ir calendar reports and presentations corporate Other articles from investopedia. com.

Understanding The Basic Principles Of Accounting Dummies

Accounting principles explanation accountingcoach.

The continuity assumption states that accounting systems assume that a business will continue to operate. the importance of the continuity assumption becomes most clear if you consider the ramifications of assuming that a business won’t continue. if a business won’t continue, it becomes very unclear how one should value assets if the assets have no resale value. if a business won’t continue operations, no assurance exists that any of the inventory can be sold. if the inventory can’t be sold, A number of basic accounting principles have been developed through common usage. they form the basis upon which the complete suite of accounting standards have been built. the best-known of these principles are as follows: accrual principle. this is the concept that accounting transaction. What are accounting principles? definition: accounting principles are the building blocks for gaap. all of the concepts and standards in gaap can be traced back to the underlying accounting principles. some accounting principles come from long-used accounting practices where as others come from ruling principles of accounting making bodies like the fasb. it’s important to have a basic understanding of these main.

basic classes will teach you about the simple principles of accounting you can learn how to use bookkeeping software There are general rules and concepts that govern the field of accounting. these general rulesreferred to as basic accounting principles and guidelinesform the groundwork on which more detailed, complicated, and legalistic accounting rules are based. for example, the financial accounting standards board (fasb) uses the basic accounting principles and guidelines as a basis for their own detailed and comprehensive set of accounting rules and standards. Accountingprinciples are the rules and guidelines followed by the different entities to record, to prepare and to present the financial statements of the company for presenting true and fair picture of those financial statements. as the name suggests, these principles are a set of rules and guidelines by maintaining which a company should.