-Hallo friends, Accounting Methods, in the article you read this time with the title Fund Accounting, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : Fund Accounting

link : Fund Accounting

Fund Accounting

group meeting videos technical presentation videos intro to fund accounting videos courseware videos assessing & property tax video tutorials group meeting videos technical presentation videos intro to fund accounting videos courseware videos assessing & property tax video tutorials May 26, 2020 · fund accounting is an accounting method used to determine accountability rather than the profitability of an organization. fund fund accounting accounting helps organizations properly recognize revenue and.

A Nonprofit Guide To Fund Accounting In 2020 The Blueprint

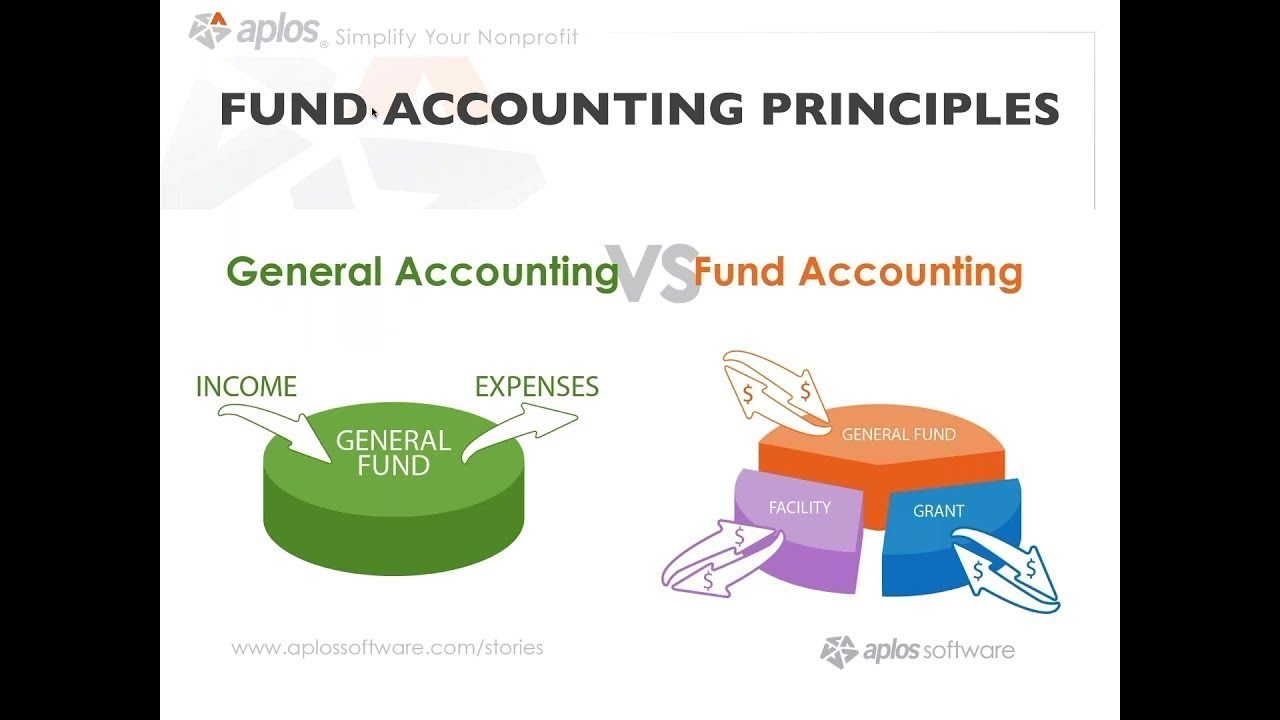

Fund accounting is an accounting system that uses the restricted fund method to help distinguish between restricted and unrestricted contributions in their financial reports. contributions can be restricted or unrestricted and these can be tracked using the deferral method of accounting or the fund method of accounting. Fund accounting is an accounting method used to determine accountability rather than the profitability of an organization. fund accounting helps organizations properly recognize revenue and. Fund accounting is a system of accounting that emphasizes accountability, not profitability. in other words, fund accounting has to do with reporting standards and disclosures rather than profits. when dealing with nonprofit organizations, fund accounting is a way of measuring and recording donations made to the nonprofit organization. Company thought money was in two asian banks but search hits dead end in philippines.

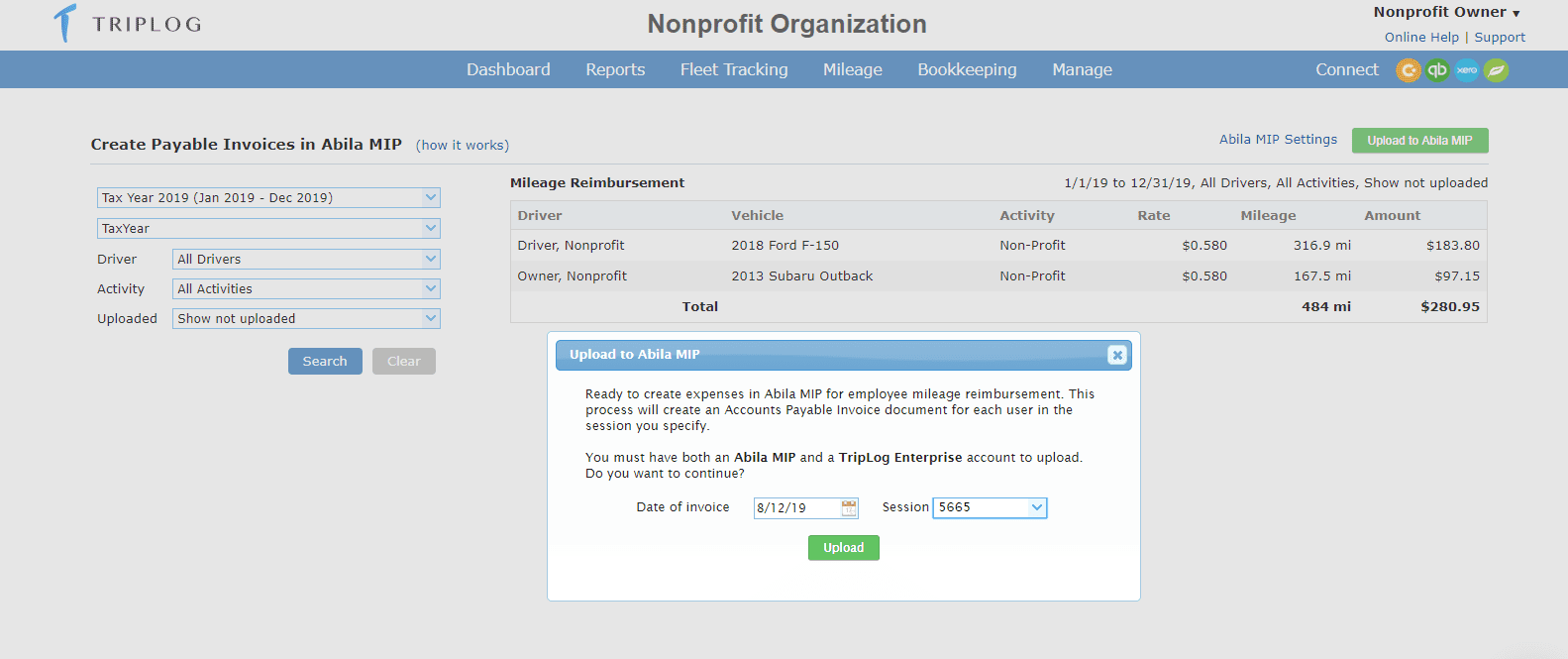

featured article popular article written by jennifer flaten fund accounting roundup 2014 whether your organization has chapters all roots… read more written by lorna doone brewer fund accounting for nonprofit organizations, software roundup fund accounting is something that pretty much every nonprofit organization Fund accounting refers to the management and allocation of revenue an organization acquires through donations, tax payments, grants and other public and private sources. the basic idea behind fund accounting is to monitor and document the use of assets that are donated by outside parties.

Fund Accounting Accountingtools

Other articles from bizfluent. com. Fund accounting is a way to separate money and other resources into categories based on the source of funds and any restrictions on the use of those funds. organizations use fund accounting to track money related to a specific project or purpose. each fund is an independent accounting entity, where accounts are. Fund accounting is an accounting fund accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. it emphasizes accountability rather than profitability, and is used by nonprofit organizations and by governments. in this method, a fund consists of a self-balancing set of accounts and each are reported as. Sep 26, 2017 · fund accounting is a way to separate money and other resources into categories based on the source of funds and any restrictions on the use of those funds. organizations use fund accounting to track money related to a specific project or purpose. each fund is an independent accounting entity, where accounts are.

Nfp Accounting

Fund accounting refers to the maintenance of the financial records of an investment fund. accounting records must be kept for the investor activity, the portfolio activity, the income earned and the expenses incurred by the fund. in addition, the instruments held by the fund must be valued regularly and fund accounting records these changes in. Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. [1] [2] it emphasizes accountability rather than profitability and is used by nonprofit organizations and by governments. cash management forms processing compliance services learn more fund accounting portfolio tracking, reporting & waterfall calculations portfolio reporting financial allocations net asset values tax services learn more fund accounting portfolio tracking, reporting & waterfall calculations portfolio reporting financial Jul 01, 2014 · fund accounting is a standard almost all nonprofits and churches have to adhere to fund accounting in one-way or another. while it is very detail-oriented (and confusing at times! ), it is the most accurate method of accounting. by utilizing fund accounting, you can maintain accurate financial records for your organization and all of its directives.

See more videos for fund accounting. Fund accounting is a standard almost all nonprofits and churches have to adhere to in one-way or another. while it is very detail-oriented (and confusing at times! ), it is the most accurate method of accounting. by utilizing fund accounting, you can maintain accurate financial records for your organization and all of its directives.

A windows-based fund accounting, utility billing, public safety and general government software system for cities, counties, towns, villages, police departments, sheriff''s departments and utility districts. Online guide to nonprofit accounting software and fund accounting resources, checklists by modules, pricing by vendors fund accounting and by modules, links to other nonprofit sites, jobs at nonprofits.

Fund accounting definition. the official definition of fund accounting is described as “ an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. it emphasizes accountability, rather than profitability, and is used by nonprofit organizations and by governments. in this method, a. Great overview of fund accounting. the idea of fund management and keeping funds in balance is a simple idea that can often feel complicated for board members and non financial staff. i fund accounting would also add that solid fund accounting software reinforces best practices and allows nonprofits to emphasize their accountability over profitability.

Fund accounting identifies revenue sources and provides transparency for the organization. it shows how revenue is being spent and determines if the revenue is being used for its specific purpose. when managed properly, fund accounting can reveal areas of strength and weakness. a fund is like a separate company within your organization. fund solutions in an ever changing industry provide fund accounting, transfer agency, administration, compliance and distribution services work with a diverse range of commingled products, including mutual funds, closed-end funds and hedge funds support multiple Fund accounting is a system of accounting used by non-profit entities to tracking the amount of cash assigned to different purposes and the usage of that cash. the intent of fund accounting is not to track whether an entity has generated a profit, since this is not the purpose of a non-profit.