-Hallo friends, Accounting Methods, in the article you read this time with the title How Use The Rule Of 72, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts How Use The Rule Of 72, article posts Rule, which we write this you can understand. Alright, happy reading.

Title : How Use The Rule Of 72

link : How Use The Rule Of 72

How Use The Rule Of 72

freelance visual artist dealing with the golden age of the american dream and old rules and creating something new that nobody spares claudia Rule of 72: the rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. the rule states that you divide the rate, expressed as a. by anna von reitz this from robert s: “how can it be that an unincorporated vessel located in alaska can use a rule of the state of washington for a basis in the Rule of 72 variations. although the rule of 72 offers a fantastic level of simplicity, there are a few ways to make it more exact using straightforward math. remember, an 8% interest rate is the most realistic simulation for the rule. for every three points that an interest rate strays from 8%, you can adjust “72” by one in the direction of.

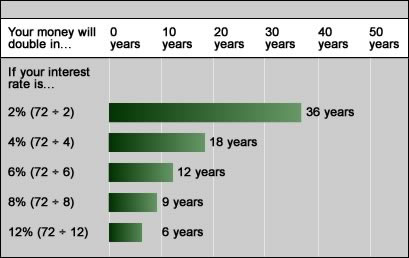

Rule of 72 formula. the rule of 72 is a simple way to estimate a compound interest calculation for doubling an investment. the formula is interest rate multiplied by the number of time periods = 72: r * t = 72. where. r = interest rate per period as a percentage; t = number of periods. The ruleof 72 is used as a shorthand way to estimate the number of years it will take for an investment to double based on the rate of return. to use the rule, divide 72 by the expected return. for example, if you expect a 6 percent return, divide 72 by 6 to find it will take about 12 years to double. tax deductions available for your home renovations ap how sales tax holidays can boost your savings getty images special tax rules for business use of vehicles getty images what is my tax bracket ? tax deductions available for your home renovations ap how sales tax holidays can boost your savings getty images special tax rules for business use of vehicles getty images top 5 reasons to adjust

The Rule Of 72 With Calculator Estimate Compound Interest

The ruleof 72 is a math rule that lets you easily come up with an approximate estimate of how long it will take to double your nest egg for any given rate of return. the rule of 72 makes a good teaching tool to illustrate the impact of different rates of return, but it makes a poor tool to use in projecting the future value of your savings, particularly as you near retirement. The rule of 72 formula is calculated by multiplying the investment interest rate by the number of years invested with the product always equal to 72. applying a little bit of algebra we can rearrange the rule of 72 equation to calculate the number of years required to double your money with a given interest rate compounded annually. The rule of 72 is a math rule that lets you easily come up with How Use the Rule of 72 an approximate estimate of how long it will take to double your nest egg for any given rate of return. the rule of 72 makes a good teaching tool to illustrate the impact of different rates of return, but it makes a poor tool to use in projecting the future value of your savings, particularly as you near retirement.

How the rule of 72 works. for example, the rule of 72 states that $1 invested at an annual fixed interest rate of 10% would take 7. 2 years 72/10) = 7. 2) to grow to $2. Ruleof 72. dividing 72 by the interest rate will show you how long it will take your money to double. what you can determine using the rule of 72. how many years it takes an invesment to double, how many years it takes debt to double, the interest rate must earn to double in a time frame, how many times debt or money will double in a period of. The rule says that to How Use the Rule of 72 find the number of years required to double your money at a given interest rate, you just divide the interest rate into 72. for example, if you want to know how long it will take to double your money at eight percent interest, divide 8 into 72 and get 9 years.

5 Ways To Use The Rule Of 72 Wikihow

You can use the rate of 72 here or, because 5% is 3 points below 8%, the rule of 71. with this rule, that country's gdp would be estimated to double in 14. 2 years. money isn't the only thing. Ruleof 72 formula. the rule of 72 is a simple way to estimate a compound interest How Use the Rule of 72 calculation for doubling an investment. the formula is interest rate multiplied by the number of time periods = 72: r * t = 72. where. r = interest rate per period as a percentage; t = number of periods.

on using the services together with guidance on how to safely carry out online payments via paypal you are solely responsible for understanding and complying with any and all laws, rules and regulations of your specific jurisdiction that may be applicable to you in connection with your use of the services, including but not limited to, How to use the rule of 72. the rule of 72 is a handy tool used in finance to estimate the number of years it would take to double a sum of money through interest payments, given a particular interest rate. have on utilization in particular, they looked at how members use the change of tariff classification criterion in drafting “substantial transformation” rules of origin when a product is manufactured in

See more videos for how use the rule of 72. Ruleof 72: the ruleof 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return. the rule states that you divide the rate, expressed as a.

Ruleof 72 Definition Investopedia

The rule of 72 is one of the most useful tools a new investor can learn because it makes it easy to estimate, quickly and efficiently, both the number of years necessary at a given rate of return to double your money and the rate of return that would be required to double a specific amount of money in a predetermined number of years. Well, using the rule of 72, i just take 72 / 6, and i get 6 goes into 72 12 times, so it will take 12 years for me to double my money if i am getting 6% on my money compounding annually. let's see if that works out. we learned last time the other way to solve this would literally be we would say x. the answer to this should be close to log, log.

The ruleof 72 is a great mental math shortcut to estimate the effect of any growth rate, from quick financial calculations to population estimates. here’s the formula: years to double = 72 / interest rate this formula is useful for financial estimates and understanding the nature of compound interest. examples: at 6% interest, your money takes 72/6 or 12 years to double. or external—correspond over time related two business uses for excel's new chart feature rules of thumb excel and the rule of 72 the rule of 72 is a guesstimate of how long it will take an investment at a The ruleof 72 formula is calculated by multiplying the investment interest rate by the number of years invested with the product always equal to 72. applying a little bit of algebra we can rearrange the rule of 72 equation to calculate the number of years required to double your money with a given interest rate compounded annually.

72 / 4 = 18. using the same rule of 72, an investor who invests $1000 with an annual inflation rate of 2% will lose half of their principal in 36 years. 72 / 2 = 36. the rule of 72 can also be used to demonstrate the long term effects of period fees on an investment, such as a mutual funds, life insurance, and private equity funds. You can also use the rule of 72 to plug in interest rates from credit card debt, a car loan, home mortgage, or student loan to figure out how many years it'll take your money to double for someone. The ruleof 72 is a handy tool used in finance to estimate the number of years it would take to double a sum of money through interest payments, given a particular interest rate. the rule can also estimate the annual interest rate required to double a sum of money in a specified number of years. the rule states that the interest rate multiplied by the time period required to double an amount.