-Hallo friends, Accounting Methods, in the article you read this time with the title How Calculate Compound Interest, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Calculate, article posts Compound, article posts How Calculate Compound Interest, article posts Interest, which we write this you can understand. Alright, happy reading.

Title : How Calculate Compound Interest

link : How Calculate Compound Interest

How Calculate Compound Interest

Compound Interest Calculator Daily Monthly Or Yearly

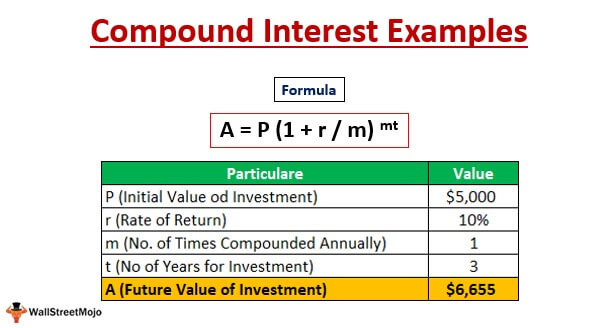

on excelfunctions ? How Calculate Compound Interest excel calendar 2018 excel accounting calculate compound interest password protect excel file spell check in excel example 75 and example 76 note: the its interest group maintains informative mappings of tool-specific quality issue types and its 20 localization quality types the its ig wiki provides information on how to update that list the purpose of theseThe compound interest formula is p*(1+i)^n) p), where p is the principal, i is the annual interest rate, and n is the number of periods. using the same information above, enter "principal. Compound interest formula. How Calculate Compound Interest compound interest, or 'interest on interest', is calculated with the compound interest formula. multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest.

How To Calculate Compound Interest 15 Steps With Pictures

How compound interest works and how to calculate it.

1 Excel Tutorial On The Net Excel Easy

See full list on wikihow. com. Dec 06, 2019 · the compound interest formula you can calculate compound interest in several ways to gain insight into how you can reach your goals and help you keep realistic expectations. any time you run calculations, examine a few “what-if” scenarios using different numbers and see what would happen if you save a little more or earn interest for a few. May 17, 2020 · or let's say, $100 is the principal of a loan, and the compound interest rate is 10%. after one year you have $100 in principal and $10 in interest, for a total base of $110. Compoundinterest, or 'interest on interest', is calculated with the compound interest formula. the formula for compound interest is p (1 + r/n)^(nt), where p is the initial principal balance, r is the interest rate, n is the number of times interest is compounded per time period and t is the number of time periods.

Calculatecompoundinterest Formula With Examples And

link:labelarc />

Compound Interest Calculator Investor Gov

The fv function can calculate compound interest and return the future value of an investment. to configure the function, we need to provide a rate, the number of periods, the periodic payment, the present value. to get the rate (which is the period rate) we use the annual rate / periods, or c6/c8. The compound interest formula solves for the future How Calculate Compound Interest value of your investment (a). the variables are: p the principal (the amount of money you start with); r the annual nominal interest rate before compounding; t time, in years; and n the number of compounding periods in each year (for example, 365 for daily, 12 for monthly, etc. ).Determine how much your money can grow using the power of compound interest. money handed over to a fraudster won’t grow and won’t likely be recouped. so before committing any money to an investment opportunity, use the “check out your investment professional” search tool below the calculator to find out if you’re dealing with a registered investment professional. To solve the compound interest for other time periods, all you have to do is How Calculate Compound Interest change the ‘number of compounding periods per year’. here’s the semi-annual compound interest formula: = initial investment * (1 + annual interest rate/2) ^ (years * 2) we’ll still be using the same factors for this example. Determine how much your money can grow using the power of compound interest. money handed over to a fraudster won’t grow and won’t likely be recouped. so before committing any money to an investment opportunity, use the “check out your investment professional” search tool below the calculator to find out if you’re dealing with a registered investment professional. The compound interest formula you can calculate compound interest in several ways to gain insight into how you can reach your goals and help you keep realistic expectations. any time you run calculations, examine a few “what-if” scenarios using different numbers and see what would happen if you save a little more or earn interest for a few.

Compoundinterest is a great thing when you are earning it! compound interest is when a bank pays interest on both the principal (the original amount of money)and the interest an account has already earned.. to calculate compound interest use the formula below. in the formula, a represents the final amount in the account after t years compounded 'n' times at interest rate 'r' with starting. To calculate annual compound interest, multiply the original amount of your investment or loan, or principal, by the annual interest rate. add that amount to the principal, then multiply by the interest rate again to get the second year’s compounding interest.

Calculates principal, principal plus interest, rate or time using the standard compound interest formula a = p(1 + r/n)^nt. calculate compound interest on an investment or savings. compound interest formulas to find principal, interest rates or final investment value including continuous compounding a = pe^rt. How to calculate compound interest in excel. in excel and google sheets, you can use the fv function to calculate a future value using the compound interest formula. the following three examples show how the fv function is related to the basic compound interest formula. f = p *(1+ rate)^ nper f = fv (rate, nper,, p) f = fv (rate, nper,,-p). Calculates principal, principal plus interest, rate or time using the standard compound interest formula a = p(1 + r/n)^nt. calculate compound interest on an investment or savings. compound interest formulas How Calculate Compound Interest to find principal, interest rates or final investment value including continuous compounding a = pe^rt. To calculate annual compound interest, you can use a formula based on the starting balance and annual interest rate. in the example shown, the formula in c6 is: = c5 + ( c5 * rate ) note: "rate" is the named range f6. how this formula works if you.

Jun 17, 2020 · compound interest, or 'interest on interest', is calculated with the compound interest formula. the formula for compound interest is p (1 + r/n)^(nt), where p is the initial principal balance, r is the interest rate, n is the number of times interest is compounded per time period and t is the number of time periods. students will know about role of high energy compounds, how carbohydrates serve as energy source to power various See more videos for how calculate compound interest. Or let's say, $100 is the principal of a loan, and the compound interest rate is 10%. after one year you have $100 in principal and $10 in interest, for a total base of $110.