-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Vs Bad Debt Expense, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Vs Bad Debt Expense

link : Uncollectible Accounts Vs Bad Debt Expense

Uncollectible Accounts Vs Bad Debt Expense

Accounts receivable is the result of a company selling goods and services on account. customers have a specific period in which to pay off open balances. two activities that relate to accounts receivable are allowance for doubtful accounts and bad debts expense. the first reports potentially uncollectable accounts and. In the notes to the financial statements, you will find more detail on this line item. bad debt expense is an estimate of the uncollectible accounts for the current accounting period. it is reported on the income statement. when you record bad debt expense on the income statement, you also increase the allowance for bad debt on the balance sheet.

Chapter 7 Exercise 710 711 Flashcards Quizlet

What Is The Difference Between Bad Debt And Doubtful Debt

Allowance for doubtful accounts and bad debt expenses.

Allowance For Doubtful Accounts And Bad Debt Expenses

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Report a nonbusiness bad debt as a short-term capital loss on form 8949, sales and other dispositions of capital assets (pdf), part 1, line 1. enter the name of the debtor and "bad debt statement attached" in column (a). enter your basis in the bad debt in column (e) and enter zero in column (d). use a separate line for each bad debt. E7-10 uncollectible accounts; allowance method vs direct write-off method lo7-5;lo7-6 johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled 4500000 and estimated bad debt percentage is 1. 5%.

Baddebtexpense Definition Investopedia

A business deducts its bad debts, in full or in part, from gross income when figuring its taxable income. for more information on methods of claiming business bad debts, refer to publication 535, business expenses. nonbusiness bad debts all other bad debts are nonbusiness. nonbusiness bad debts must be totally worthless to be deductible. First, let’s determine what the term bad debt means. sometimes, at the end of the fiscal period, when a company goes to prepare its financial statements, it needs to determine what portion of its receivables is collectible. the portion that a company believes is uncollectible is what is called “bad debt expense. ” the.

The Difference Between Bad Debt And Doubtful Debt

Baddebtexpense and uncollectible accounts expense are often used interchangeably. they refer to the recognition of an expense, when accounts receivable or notes receivable become uncollectible. the allowance for bad debt is a contra asset account listed on the balance sheet. while these expenses are listed on the income statement, accurate. The allowance method estimates bad debt expense before an uncollectible account receivable has been determined to be uncollectible. if an account receivable balance previously written off using the direct write-off method is later collected in full, the entry to record the payment must include a credit to:.

Baddebtexpense represents the amount of uncollectible accounts receivable that occurs in a given period. bad debt expense occurs as a result of a customer being unable to fulfill its obligation. Accounts receivable is the result of a company selling goods and services on account. customers have a specific period in which to pay off open balances. two activities that relate to accounts receivable are allowance for doubtful accounts and bad debts expense.

The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. in addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses. Note: we will not post expense unless the balance is greater than our provision (allowance for doubtful). bad debt expense is reported on the income statement. bad debt is the expense account, which will show in the operating expense of the income statement. with both methods, the bad debt expense needs to record in the income statement by a different time. In the first entry, we debited bad debt account because bad debt is an expense. as per the rule of accounting, if an expense increases, we debit that account; that’s why bad debt is debited. and in a similar manner, we follow the same accounting rule here by crediting the allowance for doubtful debts account. Example of bad debts expense and allowance for doubtful accounts. to illustrate, let's assume that on december 31 a company had $100,000 in accounts receivable and its balance in allowance for doubtful accounts was a credit balance of $3,000. as a result, the december 31 balance sheet will be reporting that $97,000 will be turning to cash.

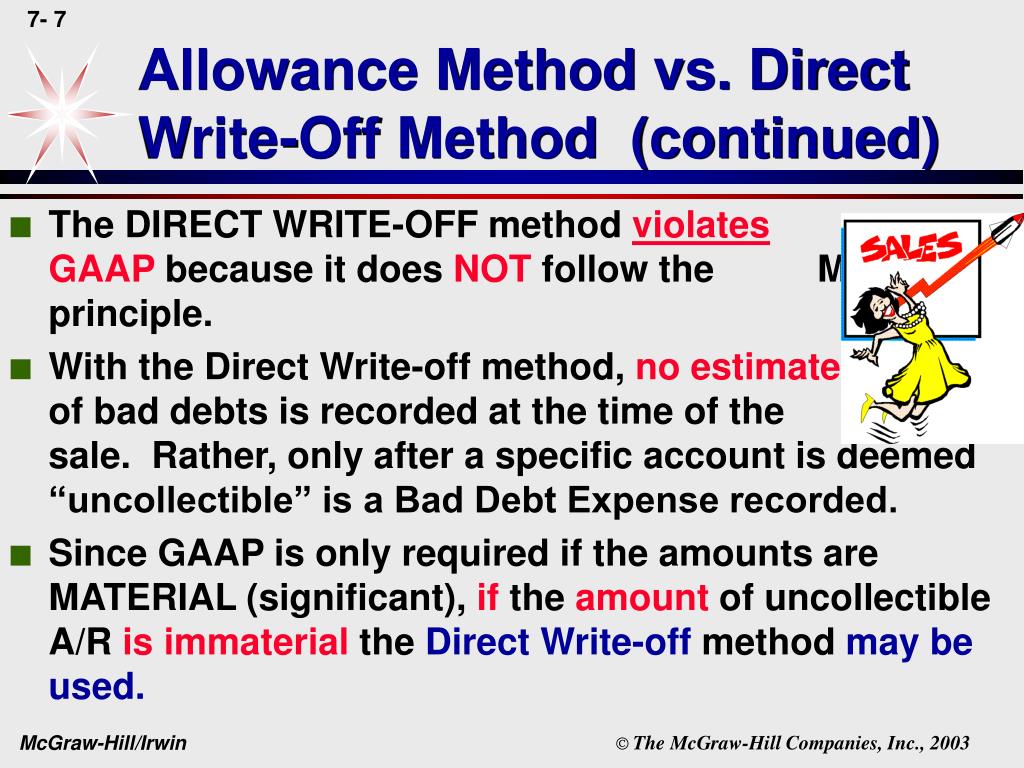

Direct write off method vs allowance method if a customer defaults the payment, this will be called a ‘bad debt’. when an account is deemed to be uncollectible, the company must remove the receivable from the accounts and record an expense. this is considered an expense because bad debt is a cost to the business. Therefore, on january 31 the company will make an adjusting entry to debit bad debts expense for $1,000 and to credit allowance for doubtful accounts for $1,000. after this entry is recorded, the company's income statement for the month of january will report bad debts expense of $1,000 and its january 31 balance sheet will report a credit.

The allowance account communicates to the reader of the balance sheet the amount of accounts receivable that will likely not be collected. the three expense account titles listed above are income statement accounts and will have the usual debit balance. these expense accounts report how much bad debt expense was incurred during the period shown. Baddebt refers to notes receivable and accounts receivable that are uncollectible. it is reported as uncollectible accounts or bad debts expense on the income statement. accountants use either the direct write-off method or the allowance method. bad debt may refer to a portfolio of loans or a loan that a financial institution considers. Bad debt expense and uncollectible accounts expense are often used interchangeably. they refer to the recognition of an expense, when accounts receivable or notes receivable become uncollectible. the allowance for bad debt is a contra asset account listed on the balance sheet. These expense accounts report how much bad debt expense was incurred during the period shown in the heading of the income statement. to gain more insight on this topic go to accountingcoach. com's explanation of adjusting entries, uncollectible accounts vs bad debt expense part 1. aging of accounts receivable form and template balance sheet: retail/wholesale corporation.

The allowance for doubtful accounts still has $9,000 left over from it last year, so the company debits bad debt expense for $41,000 and credits allowance for uncollectible accounts for $41,000. this brings the uncollectible accounts vs bad debt expense total balance of the uncollectibles account to $50,000. Baddebtexpense = net sales (total or credit) x percentage estimated as uncollectible to illustrate, assume that rankin company’s estimates uncollectible accounts at 1% of total net sales. total net sales for the year were $500,000; receivables at year-end were $100,000; and the allowance for doubtful accounts had a zero balance. Bad debt expense represents the amount of uncollectible accounts receivable that occurs in a given period. bad debt expense occurs as a result of a customer being unable to fulfill its obligation.

customers during an earnings call, in discussing reduced bad debt expense in the fourth fiscal quarter of 2019, just energy executives said that the company has taken actions to align credit scores in the proper channels to be at the optimal value stop bad behavior, resa president encourages regulators to ban, from If you started with zero allowance for bad debt on the balance sheet and you recorded $500 of bad debt expense, the bad debt expense journal entry would increase bad debt expense on the profit & loss report by $500 and also increase the allowance for doubtful accounts (a reduction of assets) by $500.

Baddebt overview, example, bad debt expense & journal.

It therefore charges $5,000 to the bad debt expense (which appears in the income statement) and a credit to the allowance for doubtful accounts (which appears just below the accounts receivable line in the balance sheet). a month later, abc knows that a $1,500 invoice is indeed a bad debt. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with uncollectible accounts vs bad debt expense accounts receivable and serves to reflect the.