-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Recovered, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Recovered

link : Uncollectible Accounts Recovered

Uncollectible Accounts Recovered

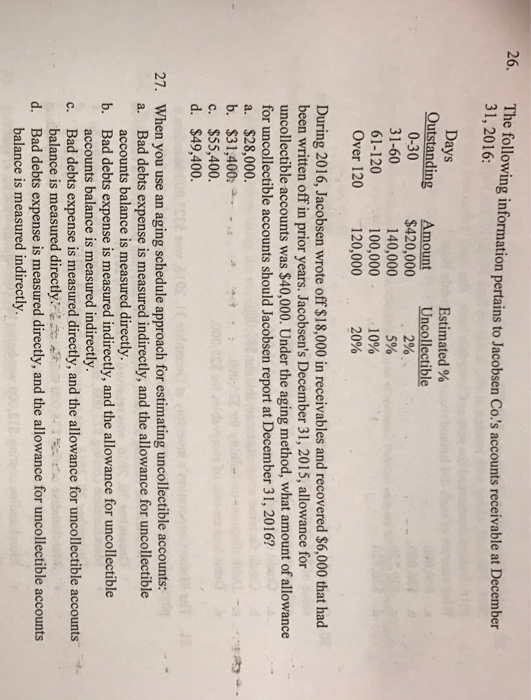

A company that estimates its uncollectible accounts receivable are $5,000 and a $200 credit balance in allowances for uncollectible accounts will increase the allowance account by $5,200. false. an aging of accounts receivable analyzes accounts receivable by age categories according to when payments are due. It wrote off as uncollectible accounts receivable of $6,689. however, a $2,793 account previously written off as uncollectible was recovered before the end of the current period. uncollectible accounts are estimated to total $27,030 at the end of the period (omit cost of goods sold entries. ). files to decrease amount for partially bypassable generation uncollectibles rider advertisement retailenergyx : firstenergy solutions: "expectation" nuclear subsidy When an uncollectible account is recovered after it has been written off, which of the following accounts will be credited in the process? accounts receivable and allowance for doubtful accounts. t/f: bad debts expense is a nominal account and is closed at the end of the fiscal period, while allowance for doubtful accounts is a real account and.

The account number/code for indirect cost recoveries-federal is 472100. other receivables from the federal government related to revenue generating activities such as tuition, fees, veterans’ processing allowances, etc. that result in uncollectible accounts will be handled in the uncollectible accounts recovered same manner as uncollectible amounts discussed in section 10. 3. 1. Uncollectible accounts written off during the year 18,000 uncollectible accounts recovered during the year 2,000 accounts receivable at 12/31 350,000 for the year, what would be inge's uncollectible accounts expense (gleim)? a) $15,000 b) $21,000 c) $11,000 d) $5,000. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Allowance For Doubtful Accounts Deduction Technique

The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable. Techniques for collection of accounts receivable shall include use of credit reporting bureaus, judicial remedies authorized by law, and administrative setoff by a reduction of an individuals tax refund pursuant to the setoff debt collection act, chapter 105a of the general statutes, or a reduction of another payment, other than payroll, due from the state to a person to reduce or eliminate an.

Answered At The Beginning Of The Current Period Bartleby

Above, we assumed that the allowance for doubtful accounts began with a balance of zero. if instead, the allowance for uncollectible accounts began with a balance of $10,000 in june, we would make the following adjusting entry instead: $50,000 $10,000 = $40,000 (adjusting entry). A bad debt recovered during the year will be,a bad debt recovered during the year will be,a company with a debt ratio of 20 would always be a bad investment,a nonbusiness bad debt,a recovery of. Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; however. The vendor department is responsible for requesting approval to write off uncollectible accounts at least quarterly. in each request, the vendor department indicates the collection procedures followed and the reasons the accounts are considered uncollectible. university management reviews all write-offs in accordance with the following guidelines:.

The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). Allowance for uncollectible accounts at 1/1credit balance $ 28,000 accounts written off as uncollectible during the year 23,000 accounts receivable at 12/31 270,000 uncollectible accounts recovered during the year 5,000 for the year ended december 31, orr's uncollectible accounts expense is.

30 56 Accounts Receivable Prf Site Washington State

A bad debt recovery is a payment received after it has been designated as uncollectible. this may occur after legal action has been taken to recover a receivable, as a partial payment from a bankruptcy administrator, the acceptance of equity in exchange for cancellation of the receivable, or some similar situation. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Allowance for uncollectible accounts 1600 if, however, there had been a debit balance of $200 then a credit to allowance for uncollectible accounts of $2,000 would be necessary to bring the closing balance to $1,800.

A account receivable that has previously been written off may subsequently be recovered uncollectible accounts recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. It is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. journal entries: the accounting treatment of recovered amount requires two journal entries.

Acc 310 Intermediate Accounting I Flashcards Quizlet

Bad debt recovery: a bad debt recovery is business debt from a loan, credit line or accounts receivable that is recovered either uncollectible accounts recovered in whole or in part after it has been written off or classified as. During the period, it had net credit sales of $787,700 and collections of $755,550. it wrote off as uncollectible accounts receivable of $7,106. however, a $3,300 account previously written off as uncollectible was recovered before the end of the current period. uncollectible accounts are estimated to total $23,450 at the end of the period.

Doubtful accounts represent the amount of money deemed to be uncollectible by a vendor. adding an allowance for doubtful accounts to a company’s balance sheet is particularly important because it allows a company’s management to get a more accurate picture of its total assets. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current uncollectible accounts recovered period. uncollectible accounts are estimated to total $25,000 at the end of the period. On january 1, 2019, king company’s allowance for doubtful accounts had a credit balance of $15,000. during 2019, king (1) charged $32,000 to bad debt expense, (2) wrote off $23,000 of uncollectible accounts receivable, and (3) unexpectedly recovered $6,000 of bad debts written off in the prior year. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each.