-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Receivable Quizlet, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Receivable Quizlet

link : Uncollectible Accounts Receivable Quizlet

Uncollectible Accounts Receivable Quizlet

Direct For The Accounting Of Write Debts Bad Uncollectible

Accounting test 2 flashcards quizlet.

Abbott corporation makes use of the allowance method of accounting for uncollectible accounts. abbott estimates that 3% of credit score income could be accounts method write-off for receivable accounting direct the uses uncollectible of uncollectible. on january 1, the allowance for doubtful accounts had a credit score stability of $2,400. at some stage in the 12 months, abbott wrote off bills. This figure assumes gross accounts receivable is $75,500. when you determine that a particular customer’s account is uncollectible (maybe the customer died and uncollectible accounts receivable quizlet left no estate or closed up shop), your next step is to remove the balance from both allowance for uncollectible accounts and the customer accounts receivable balance.

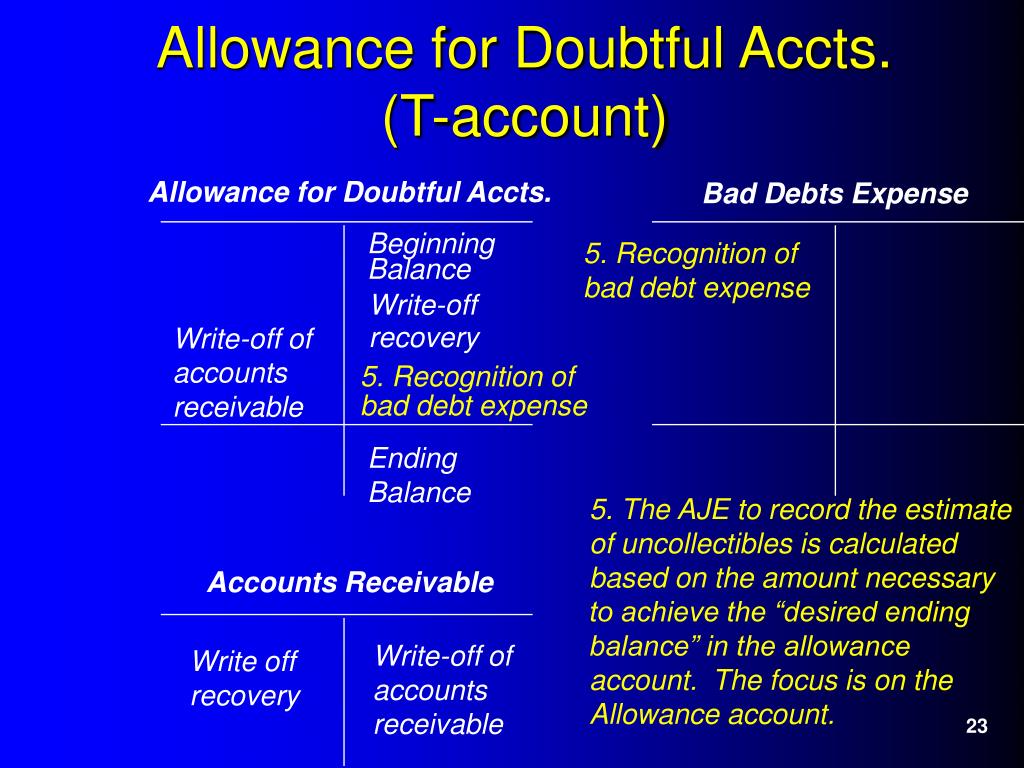

Accountsreceivable aging is a report categorizing a company's accounts receivable according to the length of time an invoice has been outstanding. Valuing accounts receivable 5. (l. o. 3) companies record credit losses as debits to bad debt expense (or uncollectible accounts expense). such losses are considered to be a normal and necessary risk of doing business. two methods are used in accounting for uncollectible accounts: (a) the direct write-off method and (b) the allowance method. Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company uncollectible accounts receivable quizlet does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

Start studying chapter 7part 2. learn vocabulary, terms, and more with flashcards, games, and other study tools. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. The book value of accounts receivable is the difference between the balance of accounts receivable and the balance of allowance for uncollectible accounts. false allowance for uncollectible accounts is classified as a contra asset account and appears uncollectible accounts receivable quizlet on the balance sheet as a deduction from cash in bank. A company that estimates its uncollectible accounts receivable are $5,000 and a $200 credit balance in allowances for uncollectible accounts will increase the allowance account by $5,200 false an aging of accounts receivable analyzes accounts receivable by age categories according to when payments are due.

Accounting Chapter 9 Quiz Flashcards Quizlet

Fin ch 8 quizlet 1) net realizable value of receivables is gross receivables minus a. bad debt expense and sales returns. b. bad debt expense and estimated returns and allowances c. estimated uncollectible, returns and allowances. d. proven uncollectible and estimated returns and allowances. 2) the matching principle requires that bad debts be treated as an expense in the year 3) the. Answer to entries for uncollectible debts, using direct write-off technique obj. 3journalize the following transactions within the. more co. uses the direct write-off approach of accounting for uncollectible debts receivable. the access to put in writing off an account that has been decided to be uncollectible might be as follows: a. debit income returns and allowances; credit accounts receivable.

Chapter 14accounting For Uncollectible Accounts Receivable

The aging method of estimating uncollectible accounts method is based on the assumption that the longer an account receivable remains outstanding, the less likely it is to be collected. this statement is. Bad expense is estimated by the aging-of-receivables method. management estimates that $2,850 of accounts receivable will be uncollectible. calculate the amount of net accounts receivable after the adjustment for bad debts. a. $19,150 b. $20,150 c. $18,150 d. $17,650.

Accounting: uncollectible accounts flashcards quizlet.

The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). In order to properly account for uncollectible accounts receivable, companies reduce their resources and sources of resources for estimated uncollectible accounts receivable. for example, if a company with $50,000 of january credit sales estimates that 1. 5% of such sales will not be collected, it would be affected as follows. Based on the assumption that the longer an account receivable is outstanding, the less likely that it will be collected 1. due date 2. of days each acc past due 3 place in an age class according to its days past due 4 total for each age class 5 total each age class x by estimated 5 % of uncollectible accounts for that class.

The directwrite-offmethod recognizes horrific bills as an price on the factor when judged to be uncollectible and is the required method for federal earnings tax functions. the allowance approach presents earlier for uncollectible money owed think about as placing apart money in a reserve account. accounts receivable $21,000 terrible money owed. Estimates desired ending balance of the allowance for uncollectible accounts as a percentage of the current ending balance of accounts receivable (based on historical rates of a/r that is uncollected) balance sheet approach based on a b/s number : accounts receivable calculates a b/s number : allowance for uncollectible accounts. The directwriteoffmethod involves charging horrific debts to cost only whilst individual invoices had uncollectible accounts receivable quizlet been recognized as uncollectible. the specific action used to write off an account receivable underneath this technique with accounting software program is to create a credit score memo for the customer in query, which offsets the amount of the.

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. Start studying chapter 14:accounting for uncollectible accounts receivable. learn vocabulary, terms, and more with flashcards, games, and other study tools.

Go through your uncollectible accounts from the past three years and tell me how many of those accounts passed the gut check. eight things you uncollectible accounts receivable quizlet can do right now to avoid past due accounts 1. 166-1(e. thus, for cash-basis taxpayers, a bad debt deduction is generally not allowed for uncollectible accounts receivable since these items are normally. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. (2). writing off accounts receivable at january 12, 2015: (3). recognition of accounts receivable expense at december 31, 2015: * 4,800 (4,500 1,200) notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already.