-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Journal Entry, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Journal Entry

link : Uncollectible Accounts Journal Entry

Uncollectible Accounts Journal Entry

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

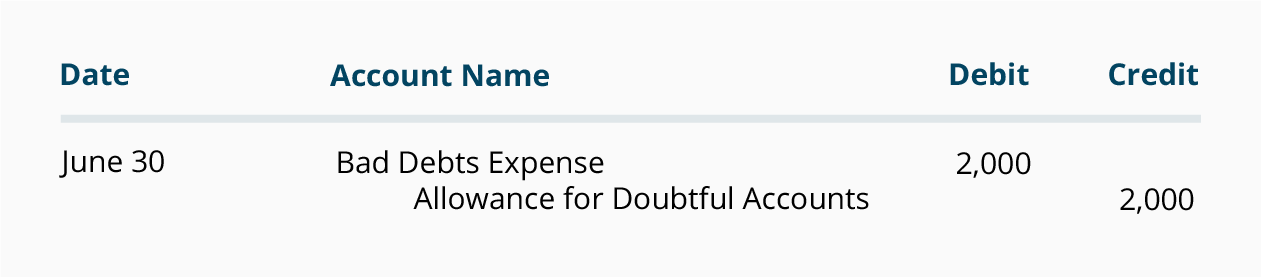

The allowance account is established and adjusted with the following journal entry: debit bad debts expense, and; credit allowance for doubtful accounts. when a specific customer's account is identified as uncollectible, the journal entry to write off the account is: a credit to accounts receivable uncollectible accounts journal entry (to remove the amount that will not be collected). [q1] the entity estimates that $2,000 of its accounts receivable may be uncollectible. prepare a journal entry to record this transaction. [journal entry]. There are two general approaches to estimate uncollectible accounts expense. the first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach. journal entry to recognize uncollectible accounts expense:.

Accounting quiz pre quiz: 9 flashcards quizlet.

Allowance For Doubtful Accounts Definition Journal Entries

Account receivable is the amount which the company owes from the customer for selling its goods or services and the journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the sales account. Allowance for doubtful accounts journal entry. to predict your company’s bad debts, you must create an allowance for doubtful accounts entry. you must also use another entry, bad debts expense, to balance your books. increase your bad debts expense by debiting the account, and decrease your ada account by crediting it. When an interest-bearing note comes due and is uncollectible, the journal entry includes debiting a. notes receivable and crediting accounts receivable. b. notes receivable and crediting accounts rece. The journal entry also credits the accounts receivable account for $100. in combination, these two entries zero out the allowance for the uncollectible a/r account and remove the uncollectible amount from the accounts receivable account. writing uncollectible accounts journal entry off an actual, specific uncollectible receivable for invoice should be done on a case-by-case basis.

The first journal entry above would affect the income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account. and the second and third journal entries will only affect the balance sheet where we will first deduct the amount of provision from the accounts receivables and if any amount is. The journal entry is to debit allowance for uncollectible accounts for $1,000 and credit a/r parmelee supplies for $1,000. about the book uncollectible accounts journal entry author maire loughran is a certified public accountant who has prepared compilation, review, and audit reports for fifteen years. If rankin had a $300 credit balance in the allowance account before adjustment, the entry would be the same, except that the amount of the entry would be $ 5,700. the difference in amounts arises because management wants the allowance account to contain a credit balance equal to 6% of the outstanding receivables when presenting the two accounts on the balance sheet. The allowance for doubtful accounts on the balance sheet is increased by credit journal entry. it should be noted that the adjustment is made irrespective of the balance already on the allowance account, and for this reason the allowance account balance can build up irrespective of the level of accounts receivable.

During the year, kiner company made an entry to write-off a $16,000 uncollectible account. before this entry was made, the balance in accounts receivable was $200,000 and the balance in the allowance account was $18,000. the net realizable value of accounts receivable after the write-off entry was. In this entry, we are debiting allowance for doubtful debts because by this amount the counter-asset has been reduced and we’re crediting accounts receivables to reduce the outstanding accounts receivables by $120,000. journal entries 3. now let’s say that the company has asked a collection agency to try out to recover the bad debts.

When a written of account is recovered, the first step is to reinstate it in the accounting record. the following journal entry is made for this purpose: notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. see uncollectible accounts expense allowance method. (2). Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

How To Remove Uncollectible Accounts Receivable Dummies

Uncollectibleaccounts expense was debited in the above journal entry in order to recognize the expense of selling to some customers who will not pay. since expenses decrease stockholders equity, and stockholders' equity decreases with debits, uncollectible accounts expense was debited. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected. The journal entry to reinstate the receivable would include a allowance for doubtful accounts. under the allowance method for uncollectible accounts, the journal entry to record the estimate of uncollectible accounts would include a credit to.

How To Estimate Uncollectible Accounts Dummies

Once the estimated amount for the allowance account is determined, a journal entry will be needed to bring the ledger into agreement. assume that ito’s ledger revealed an allowance for uncollectible accounts credit balance of $10,000 (prior to performing the above analysis). The journal entry used to write off an uncollectible account is the same, regardless of the method used to calculate the estimate of allowance for uncollectible accoutns true a company may continue its attempts to collect an account even after the account has been written off. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts).