-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Formula, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Formula

link : Uncollectible Accounts Formula

Uncollectible Accounts Formula

The allowance for doubtful accounts is paired with and offsets accounts uncollectible accounts formula receivable. the allowance represents management’s best estimate of the amount of accounts receivable that will not be paid by customers. when the allowance is subtracted from accounts receivable, the remainder is the total amount of receivables that a business actually. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

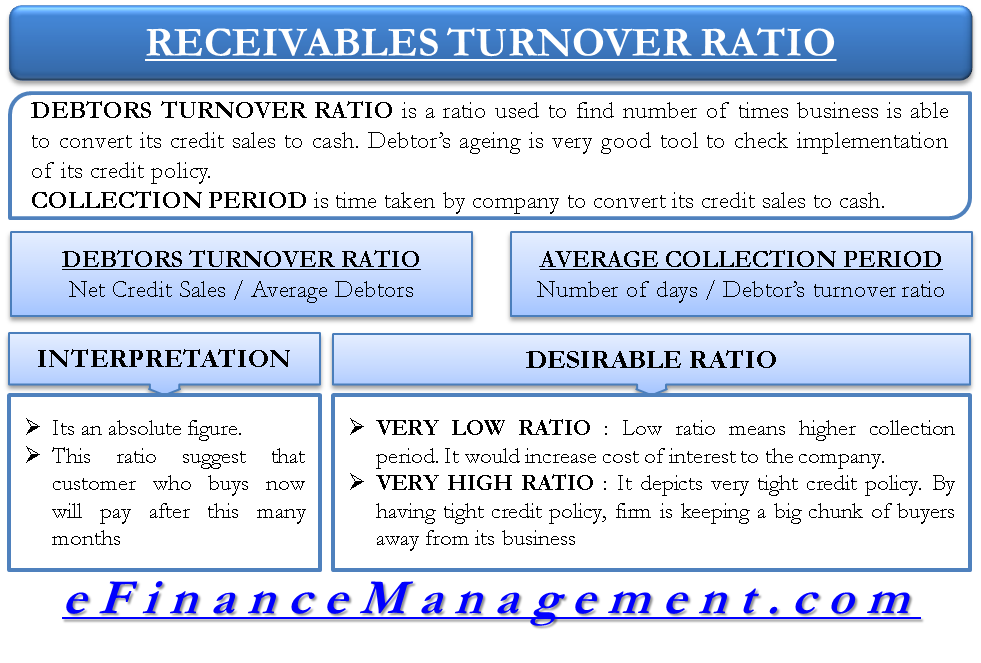

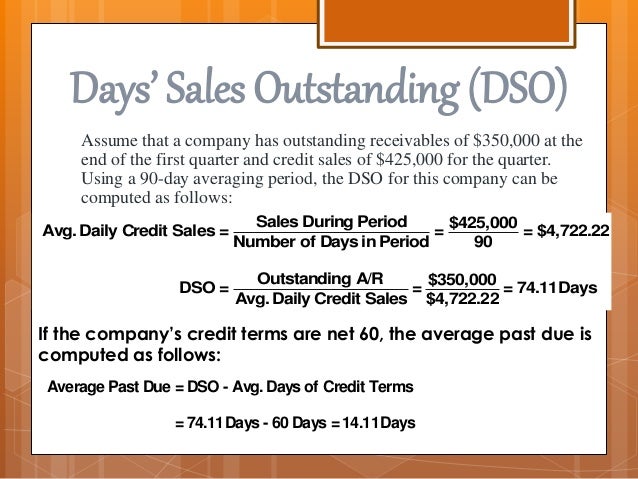

Allowance for uncollectible accounts : definition allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. A company has an ending accounts receivable balance of $1800000 and it estimates that uncollectible accounts will be 2% of the receivable balance. if allowance for doubtful accounts has a credit balance of $4,000 prior to adjustment, its balance after adjustment will be a credit of. The uncollectible accounts formula accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is collecting revenue and by extension, how efficiently it is using its assets. the accounts receivable turnover ratio measures the number of times over a given period formula for.

Accounts Uncollectible Definition Investopedia

Understand why and how allowance for uncollectible accounts are established. know how to write off an account, and reinstate an account previously written off, using the allowance method. be able to calculate accounts receivable turnover and days outstanding, and understand the importance of these measures. Allowance for uncollectible accounts : definition allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. allowance for uncollectible accounts. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts.

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the uncollectible accounts formula journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap.

Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. for example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for.

Allowance For Doubtful Accounts Accountingtools

Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. The formula for calculating the amount of uncollectible accounts expense based on a percentage of net sales is: net sales time percentage equals estimated uncollectible accounts expense true a company that estimates its uncollectible accounts receivable are $5,000 and a $200 credit balance in allowances for uncollectible accounts will increase. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

The percentage-of-sales method is commonly used to estimate the accounts receivable that a business expects will be uncollectible. when you use this method, use your small business’s past collection data to estimate what portion of the credit sales you generate each accounting period that will go unpaid. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first. The allowance for doubtful accounts is paired with and offsets accounts receivable. the allowance represents management’s best estimate of the amount of accounts receivable that will not be paid by customers. when the allowance is subtracted from accounts receivable, the remainder is the total amount of receivables that a business actually expects to collect. The general ledger account for accounts receivable shows a debit balance of $40,000. the allowance for uncollectible accounts has a credit balance of $2,000. net sales for the year were $250,000. in the past, 3 percent of net.

Accounts receivable turnover ratio formula, examples.

Percentage of sales method for calculating doubtful accounts. the percentage-of-sales method is commonly used to estimate the accounts receivable that a business expects will be uncollectible. when you use this method, use your small business’s past collection data to estimate what portion of the credit sales you. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income.

Accounts Receivable Turnover Ratio Formula Examples

Percentage of bad debt = bad debt/total accounts receivable. allowance method journal entries. for example, based on the history data, company xyz estimates that 2% of their accounts receivable will be uncollectible. on 01 jan 202x, the company makes selling on the credit of $ 50,000 from many customers. An allowance for doubtful accounts is your best guess of the bills your customers won't pay or will pay only partially. you can calculate the allowance subjectively, based on your knowledge of a customer's payment habits or ability to pay, or you can use an allowance for doubtful accounts formula based on the past experience of actual bad debt expense. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:.

Percentage of sales method for calculating doubtful accounts.

The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable. Accountsuncollectible are loans, receivables uncollectible accounts formula or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.