-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Expense Meaning, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Expense Meaning

link : Uncollectible Accounts Expense Meaning

Uncollectible Accounts Expense Meaning

Uncollectible: something that cannot be collected despite all efforts made. "the company was forced to seek legal advice to explore any remaining options after the account was designated as uncollectible. ". Go through your uncollectible accounts from the past three years and tell me how many of those accounts passed the gut check. eight things you can do right now to avoid past due accounts 1. 166-1(e. thus, for cash-basis taxpayers, a bad debt deduction is generally not allowed for uncollectible accounts receivable since these items are normally.

Under the allowance method of accounting for uncollectible accounts, bad debt expense is debited a. when a credit sale is past due. b. at the end of each accounting period. c. whenever an account is deemed worthless. d. whenever a predetermined amount of credit sales has been made. The offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. in accounting, an item is deemed material if it is large enough to affect the judgment of an informed financial statement user. Definition of uncollectible accounts expense: alternative term for bad debt expense. dictionary term of the day articles subjects businessdictionary. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first.

What Is Uncollectible Accounts Expense Definition And Meaning

Uncollectible Definition Of Uncollectible At Dictionary Com

A bad debt uncollectible accounts expense meaning is an account receivable that has been clearly identified as not being collectible. this means that a specific account receivable is removed from the accounts receivable account, usually by creating a credit memo in the billing software and then matching the credit memo against the original invoice; doing so removes both the credit memo and the invoice from the accounts receivable. Accounting equation 06. accounting principles 07. financial accounting 08. adjusting entries 09. financial statements 10. balance sheet 11. working capital and liquidity 12. income statement 13. cash flow statement 14. financial ratios 15. bank reconciliation 16. accounts receivable and bad debts expense 17. accounts payable 18.

Then companies must apply a certain percentage of accounts receivable to the uncollectible accounts account using the percentage rate determined by analyzing the historical data. direct charge-off method: meaning. one way to record the affects of uncollectible accounts is the direct charge-off method. this method is simple. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; however. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense.

Related to accounts uncollectible: allowance for doubtful accounts, uncollectible debt bad debt any bill submitted for payment by a third-party payer or patient which is not paid in full, and unlikely to be paid for various reasons. Uncollectibleaccountsexpense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches the expense to the related sale within the same reporting period. Uncollectibledefinition, that cannot be collected: an uncollectible debt. see more. Uncollectibleaccountsexpense: when a business or company does not receive payment for goods or services, the transaction must be recorded as an expense for unpaid balance.

Accounts Uncollectible Definition Investopedia

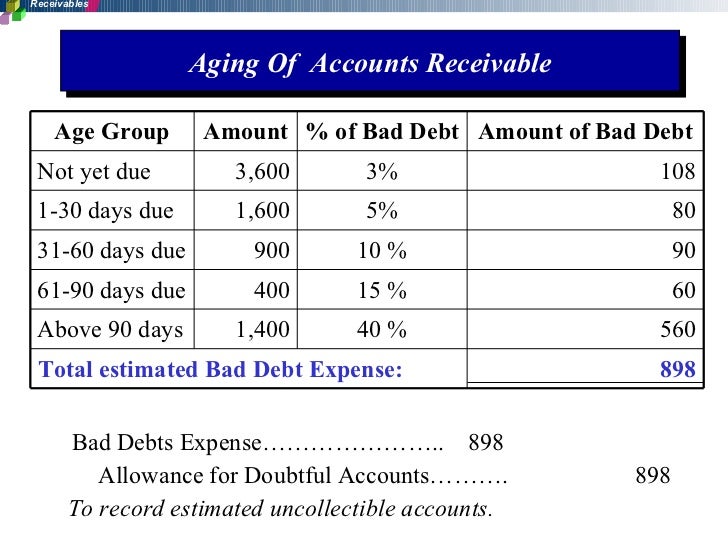

Definition: allowance for doubtful accounts, also called the allowance for uncollectibleaccounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected. in other words, it’s an account used to discount the accounts receivablea ccount and keep track of the customers who will probably not pay their current balances. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Allowance for uncollectible accounts. allowance for uncollectible accounts explained. when companies sell products to customers on credit, the customer receives the product and agrees to pay later. the customer’s obligation to pay later is recorded in accounts receivable on the balance sheet of the selling company.

Uncollectible Accounts Expense Definition And Meaning

The financial accounting term allowance method refers to an uncollectible accounts receivable process that records an estimate of bad debt expense in the same accounting period as the sale. the allowance method is used to adjust accounts receivable appearing on the balance sheet. The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts uncollectible accounts expense meaning and credits accounts receivable. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Uncollectible accounts expense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches.

Uncollectible definition, that cannot be collected: an uncollectible debt. see more. Accounts receivable and bad debts expense 17. accounts payable 18. inventory and cost of goods sold 19. depreciation 20. payroll accounting 21. bonds payable 22. stockholders' equity 23. present value of a single amount 24. present value of an ordinary annuity 25. future value of a single amount 26. nonprofit accounting 27. Allowance uncollectible accounts expense meaning for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be.

How to calculate uncollectible accounts expense basic.

Direct writeoff approach definition and which means. directwrite-offmethod. a simple technique to account for uncollectible bills is the direct write-off approach. beneath this approach, a specific account receivable is eliminated from the accounting facts on the time it is sooner or later determined to be uncollectible. the proper entry for the direct write-off method is as follows:. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense meaning uncollectible accounts expense must be recorded to remain compliant with u. s. gaap.