-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Example, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Example

link : Uncollectible Accounts Example

Uncollectible Accounts Example

Allowance For Doubtful Accounts Definition Journal Entries

Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown as a contra asset account that reduces the gross receivables on the balance sheet to reflect the net amount that is expected to be paid. Allowance for uncollectible accounts : definition allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, uncollectible accounts example the selling company must write-off the unpaid bill as uncollectible. allowance for uncollectible accounts.

Accountsuncollectible definition investopedia.

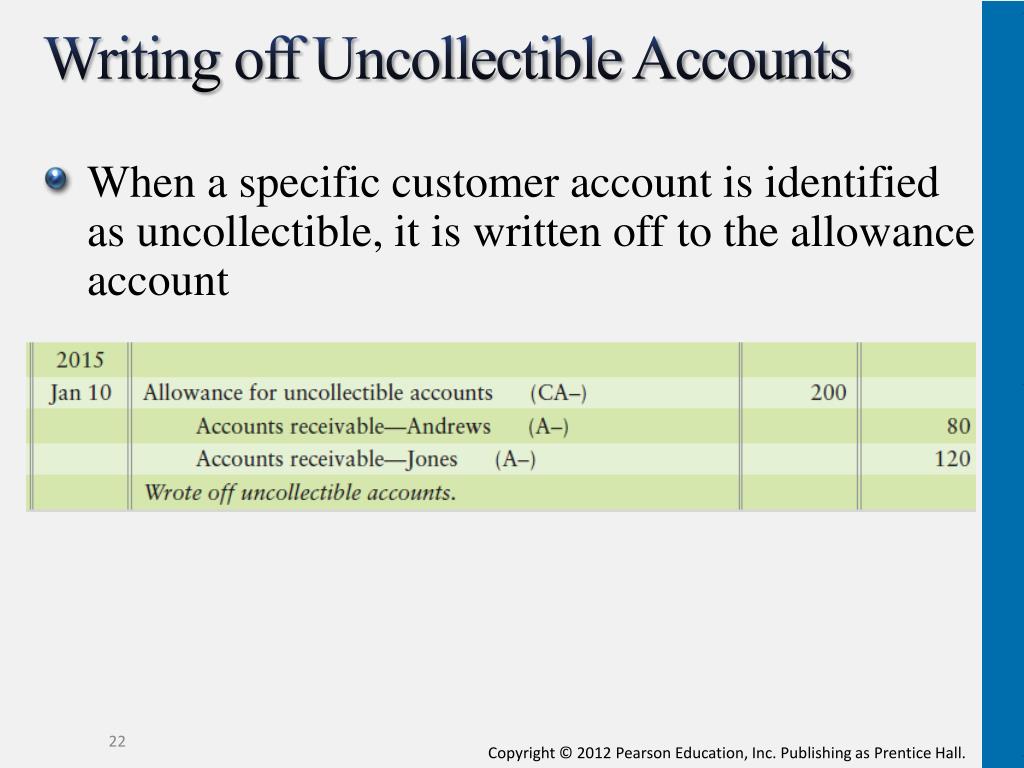

A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Bad debts expense represents the uncollectible amount for credit sales made during the period. allowance for bad debts, on the other hand, is the uncollectible portion of the entire accounts receivable. uncollectible accounts example you can also use doubtful accounts expense and allowance for doubtful accounts in lieu of bad debts expense and allowance for bad debts. Recognition of uncollectible accounts expense through a year-end adjusting entry 2. write-off of uncollectible accounts 3. recognition of revenue on account. 4. collection of cash from accounts receivable required show the effect of each event on the elements of the financial statements, using a horizontal statements model like the one shown here. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Uncollectibleaccount Financial Definition Of

Allowance for doubtful accounts overview, guide, examples.

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. Allowance for uncollectible accounts : definition allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. Also notice that in the first entry the estimated uncollectible accounts and allowance for doubtful accounts are the same at december 31, 2014. the reason is that it is the first year of company’s operation and there does not already exist any allowance for doubtful accounts. in this example, allowance for doubtful accounts is given.

Adjusting Entry For Bad Debts Expense Accountingverse

For example, if a company averages five percent uncollectible accounts for the past two years, it is reasonable book that percentage as uncollectible, over the course of the current year. the direct write-off method, however, calls for recognition of bad debts expense as accounts become uncollectible. For example, a water utility's loss from an uncollectible account receivable as a result of a major customer's deteriorating financial condition leading to the bankruptcy of that customer subsequent to the statement of net assets date may be indicative of conditions existing at the statement of net assets date, thereby calling for adjustment of.

In that example, we calculated the expected amount of uncollectible accounts in the second quarter of year one of operation, based on the allowance method, to be $168. Example of writing off an account. later, a customer who purchased goods totaling $10,000 on june 25 informs the company on august 3 that it already filed for bankruptcy bankruptcy bankruptcy is the legal status of a human or a non-human entity (a firm or a government agency) that uncollectible accounts example is unable to repay its outstanding debts to creditors. and will not be able to pay the amount owed. First, let’s determine what the term bad debt means. sometimes, at the end of the fiscal period, when a company goes to prepare its financial statements, it needs to determine what portion of its receivables is collectible. the portion that a company believes is uncollectible is what is called “bad debt expense. ” the. For example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for doubtful accounts.

Definition: allowance for doubtful accounts, also called the allowance for uncollectible accounts, is a contra asset account that records uncollectible accounts example an estimate of the accounts receivable that will not be collected. in other words, it’s an account used to discount the accounts receivablea ccount and keep track of the customers who will probably not pay their current balances. Having established that an allowance method for uncollectibles is preferable (indeed, required in many cases), it is time to focus on the details. begin with a consideration of the balance sheet. suppose that ito company has total accounts receivable of $425,000 at the end of the year, and is in the process or preparing a balance sheet. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). Here’s an example of how this works: sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each.

Bad debts expense a. k. a. doubtful accounts expense: an expense account; hence, it is presented in the income statement. it represents the estimated uncollectible amount for credit sales/revenues made during the period. allowance for bad debts a. k. a. allowance for doubtful accounts: a balance sheet account that represents the total estimated amount that the company will not be able to collect. For example, if the company had january credit sales of $15,000, it could estimate its uncollectible accounts receivable to be $210 ($15,000 uncollectible accounts example x. 014). the. 014 is the average percentage of uncollectible accounts receivable during year 1 through year 3. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts.

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. For example, if accounts uncollectible has increased, the company may be offering credit to riskier customers, which jeopardizes the reliability of the company's cash flow. however, the company may be padding the allowance in order to make things look worse than they are -because that can make future performance look better.