-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Entry, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Entry

link : Uncollectible Accounts Entry

Uncollectible Accounts Entry

Debit: accounts receivable/notes receivable credit: allowance for uncollectible accounts received cash in full payment of sanderson company's account, previously written off as uncollectible (second entry). The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable. Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

Accounting Uncollectibleaccounts Flashcards Quizlet

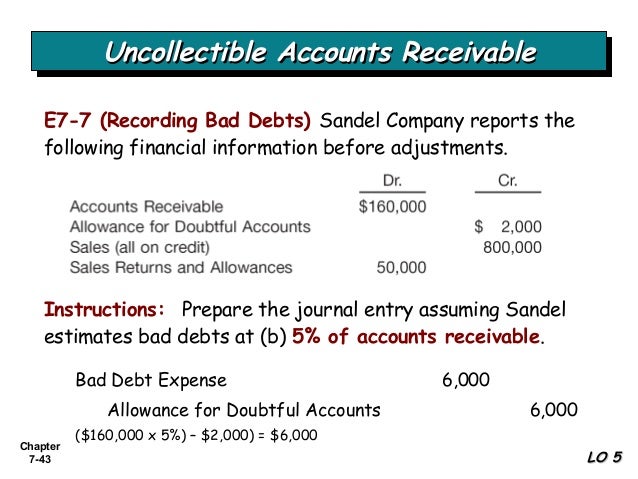

A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Using the estimate based on sales method of accounting for uncollectible accounts, the entry to reinstate a specific receivable previously written off would include a. debit to accounts receivable. at the beginning uncollectible accounts entry of the year, the balance in the allowance for doubtful accounts is a credit of $540. during the year, $350 of previously written. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

Accounting for uncollectible receivables.

Uncollectible Accounts Expense Allowance Method

How To Estimate Uncollectible Accounts Dummies

Allowance Method For Uncollectibles

Accounting for uncollectible accounts receivable: as illustrated in the previous section, the estimation of uncollectible accounts receivable results in a journal entry in which uncollectible accounts expense is debited and the allowance for uncollectible accounts is credited. this entry reduces stockholders' equity and assets. It would involve the following entry: how to estimate accounts receivables. as mentioned earlier in our article, the amount of receivables that is uncollectible is usually estimated. why? this is because it is hard, almost uncollectible accounts entry impossible, to estimate a specific value of bad debt expense. companies cannot control how or when people pay. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

Adjusting Entry For Bad Debts Expense Accountingverse

To accounts receivables a/c $120,000. in this entry, we are debiting allowance for doubtful debts because by this amount the counter-asset has been reduced and we’re crediting accounts receivables to reduce the outstanding accounts receivables by $120,000. If you had $750 in uncollectible accounts, the adjusting entry is a debit to bad debt expense for $750 and a credit to allowance for doubtful accounts for $750. balance sheet and income summary both the allowance for doubtful accounts and bad debt expense are recorded on the financial statements.

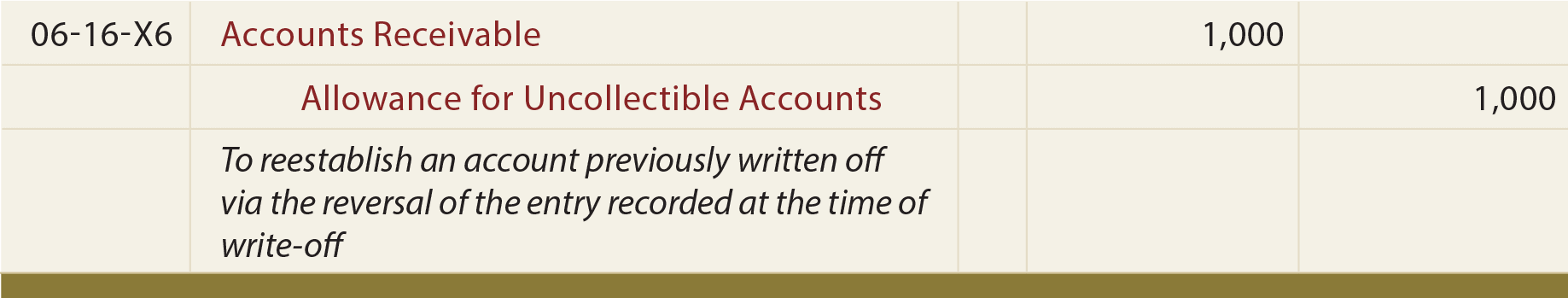

A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable.

Notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. see uncollectible accounts expense allowance method. (2). when cash is received from recovered account: the following journal entry is made when cash is received from recovered or reinstated account:. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Bad debts expense a. k. a. doubtful accounts expense: an expense account; hence, it is presented in the income statement. it represents the estimated uncollectible accounts entry uncollectible amount for credit sales/revenues made during the period. allowance for bad debts a. k. a. allowance for doubtful accounts: a balance sheet account that represents the total estimated amount that the company will not be able to collect. See more videos for uncollectible accounts entry.

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected.

The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). The first journal entry above would affect the income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account. and the second and third journal entries will only affect the uncollectible accounts entry balance sheet where we will first deduct the amount of provision from the accounts receivables and if any amount is.

The journal entry used to write off an uncollectible account is the same, regardless of the method used to calculate the estimate of allowance for uncollectible accoutns true a company may continue its attempts to collect an account even after the account has been written off. Once the estimated amount for the allowance account is determined, a journal entry will be needed to bring the ledger into agreement. assume that ito’s ledger revealed an allowance for uncollectible accounts credit balance of $10,000 (prior to performing the above analysis). files to decrease amount for partially bypassable generation uncollectibles rider advertisement retailenergyx : firstenergy solutions: "expectation" nuclear subsidy Accordingly, the company credits the accounts receivable account by $40,000 to reduce the amount of outstanding accounts receivable, and debits the allowance for doubtful accounts by $40,000. this entry reduces the balance in the allowance account to $60,000. the entry does not impact earnings in the uncollectible accounts entry current period. related courses.