-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Direct Write-off, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Direct Write-off

link : Uncollectible Accounts Direct Write-off

Uncollectible Accounts Direct Write-off

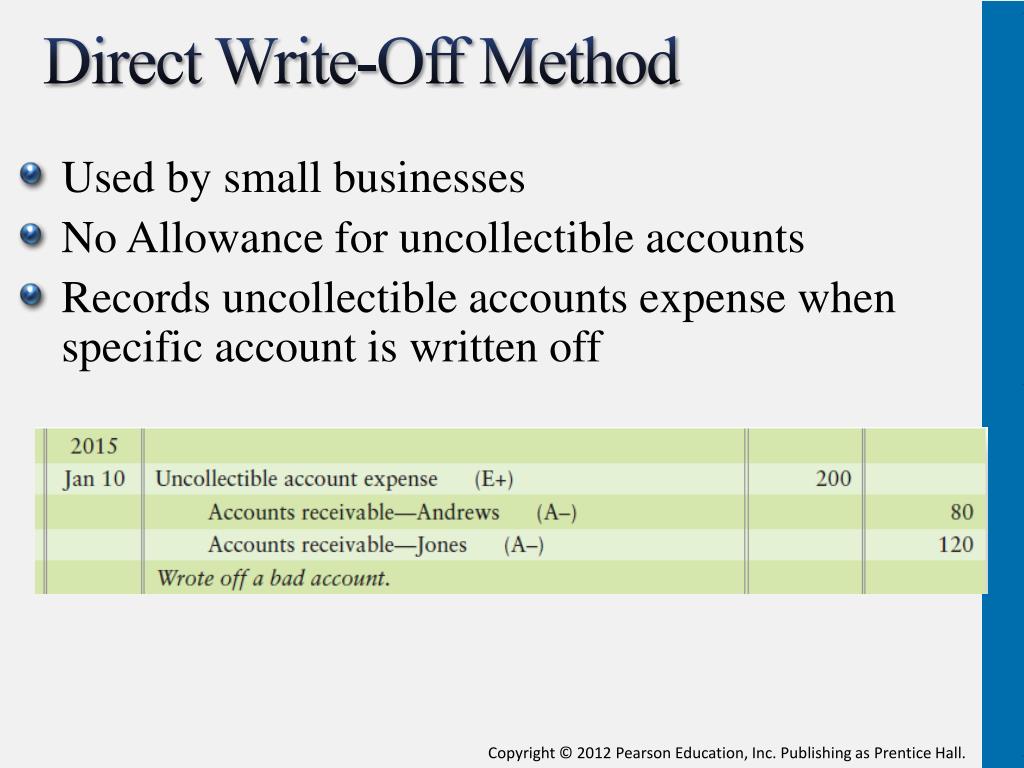

Direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Ex 9-3 entries for uncollectible accounts, using direct write-off method journalize the following transactions in the accounts of champion medical co. a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: jan. 19. sold merchandise on account to dr. dale van dyken, $30,000. In accounting, bad debts are typically written off in two ways, though the proper way to write off the bad debt depends on how you account for the possible bad debts. you can either use an allowance method or a direct write-off method. however, the generally accepted accounting principles only allows for the use of the allowance method.

Directwriteoff And Allowance Methods For Dealing With

Journal entry for the direct write-off method. one method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts receivable and recording this as a bed debt expense in the income statement of the business. Journalize the write-offs under the direct write-off method. b. journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning credit balance of $95,000 on january 1 and the company uses the analysis of receivables method. c.

(2) a extensive extent of uncollectible accounts direct write-off old uncollectible debts continues to be being caried in the debts receivable account. the direct write off approach delays the recognition of charges related to a revenue-generating transaction, and so is considered an overly competitive accounting approach, since it delays a few rate popularity, creating a reporting. The direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating the credit memo creates a debit to a bad debt. The direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. Direct write-off method definition. a method for recognizing bad debts expense arising from credit sales. under this method there is no allowance account. rather, an account receivable is written-off directly to expense only after the account is determined to be uncollectible. this method is required for income tax purposes.

The entry to write off a bad account depends on whether the company is using the direct write-off method or the allowance method. examples of the write-off of a bad account. under the direct write-off method a company writes off uncollectible accounts direct write-off a bad account receivable when a specific account is determined to be uncollectible. this usually occurs many months. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. Accounting for the valuation of accounts receivable (bad debt expense), bad debt (uncollectible debt) using (1) direct write off method, compared with (2) allowance method (for specific debt.

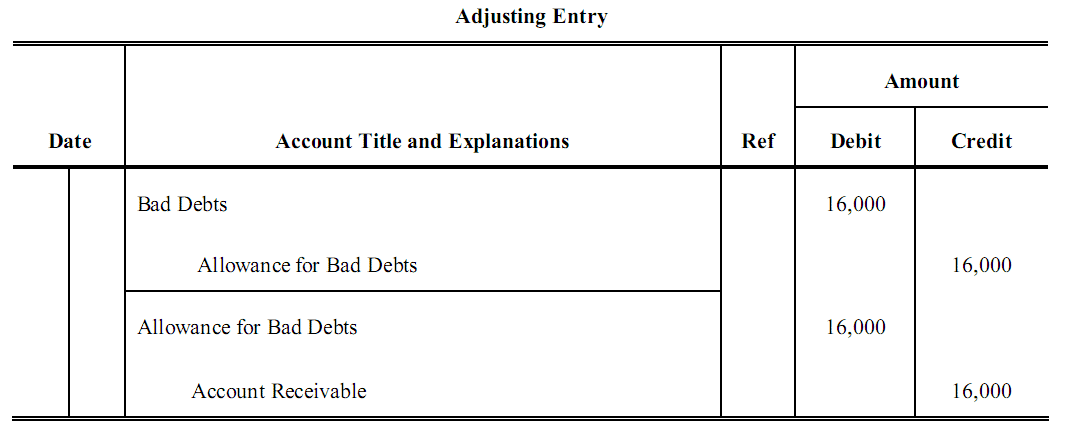

Writing Off An Account Under The Allowance Method

In the direct write-off method, uncollectible accounts receivable are directly written off against income at the time when they are actually determined as bad debts. when debt is determined as uncollectible, a journal entry is passed in which bad debts expense account is debited and accounts receivable account is credited as shown below. Unlike the direct write-off method, the allowance method records an expense to bad debt using an estimate of accounts that are unlikely to be collected before specific customer accounts are identified as being uncollectible. the estimate is determined by management and is based on a percentage of accounts receivable or sales. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. journal.

Directuncollectiblewriteoff Accounting Under For Of The

The lmn co. uses the direct write-off method of accounting for uncollectible accounts receivable. the entry to write off an account that has been determined to be uncollectible would be as follows: debit uncollectible accounts expense; credit accounts receivable. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). Directwrite-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry uncollectible accounts direct write-off for the direct write-off approach is as follows:. If the direct write-off method of accounting for uncollectible receivables is used, what general ledger account is credited when a customer's account is written off as uncollectible? a. accounts receivable b. uncollectible accounts payable c. bad debt expense d. allowance for doubtful accounts.

Answered Seaforth International Wrote Off The Bartleby

Direct Writeoff And Allowance Methods Financial Accounting

The direct write-off method is a simple accounting approach that immediately charges off bad debt (accounts receivable that a company is unable to collect). with a direct write-off, a specific. Directwriteoff approach definition and which means. directwrite-offmethod. a simple technique to account for uncollectible bills is the direct write-off approach. beneath this approach, a specific account receivable is eliminated from the accounting facts on the time it is sooner or later determined to be uncollectible accounts direct write-off uncollectible. the proper entry for the direct write-off method is as follows:.

The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. Accounts receivable is an asset on the balance sheet that represents the money customers owe. a business that uses the direct write-off uncollectible accounts direct write-off method records the full amount of an account receivable at the time of a sale. but if some of these accounts become uncollectible, the reported accounts receivable balance would be too high. Entries for bad debt expense under the direct write-off and allowance methods instructions chart of accounts journal final question instructions the following selected transactions were taken from the records of shipway company for the first year of its operations ending december 31 apr 13 wrote off account of dean sheppard, $8,300 may 15 received $590 as partial payment on the $7,270 account. The direct write-off method for bad debt. the direct write-off method allows a business to record bad debt expense only when a specific account has been deemed uncollectible. the account is removed from the accounts receivable balance and bad debt expense is increased.