-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Debit Or Credit, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Debit Or Credit

link : Uncollectible Accounts Debit Or Credit

Uncollectible Accounts Debit Or Credit

Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 $1,200) in the allowance for doubtful accounts. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts).

Mgmt 200 222 Flashcards Quizlet

The following accounts were abstracted from starr co. 's unadjusted trial balance at december 31, 2012: debit credit accounts receivable $750,000 allow for uncollectible accounts $8,000 net credit sales $3,000,000 starr estimates that 4% of the gross accounts receivable will become uncollectible. certain actions in the event that a check, credit card, debit card or account, deducting the uncollectible amount directly from the accounts

Once the estimated amount for the allowance account is determined, a journal entry will be needed to bring the ledger into agreement. assume that ito’s ledger revealed an allowance for uncollectible accounts credit balance of $10,000 (prior to performing the above analysis). The accounts receivable balance is $250000 and credit sales are $1000000. management estimates that 4% of accounts receivable will be uncollectible. what adjusting entry will nichols company make if the allowance for doubtful accounts has a credit balance of $2500 before adjustment?. When you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful uncollectible accounts debit or credit accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the true value of accounts they estimated that 1% of their credit sales would be uncollectible. Answer to entries for uncollectible debts, using direct write-off technique obj. 3journalize the following transactions within the. more co. uses the direct write-off approach of accounting for uncollectible debts receivable. the access to put in writing off an account that has been decided to be uncollectible might be as follows: a. debit income returns and allowances; credit accounts receivable.

Accounts uncollectible are loans, receivables uncollectible accounts debit or credit or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. For example, if the allowance for doubtful accounts presently has a credit balance of $2,000 and you believe there is a total of $2,900 in accounts receivable that will not be collected, you need to enter an additional credit amount of $900 into the allowance for doubtful accounts.

Debit and credit definitions. business transactions are events that have a monetary impact on the financial statements of an organization. when accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. Inasmuch as it usually has a credit balance, as opposed to most assets with debit balances, the allowance for uncollectible accounts is called a contra asset account. it is important to note why companies use the allowance for uncollectible accounts rather than simply using accounts receivable. Cr. allowance for doubtful accounts $50,000. so we have a credit balance in the account, just as we'd expect. now, when the company determines a specific receivable to be uncollectible, they 'write it off' against their allowance by recording the following entry: dr. allowance for doubtful accounts $10,000 (just an example) cr. accounts.

Debitcreditaccounts receivable $750,000 allow for uncollectible accounts $8,000 net credit sales $3,000,000 starr estimates that 4% of the gross accounts receivable uncollectible accounts debit or credit will become uncollectible. after adjustment at december 31, 2012, the allowance for uncollectible accounts should have a credit balance of. $ 354,000 debit: allowance for uncollectible accounts: 610 credit: net sales: 799,000 credit: all sales are made on credit. based on past experience, the company estimates that 0. 3% of credit.

Accounting Quiz Flashcards Quizlet

The percentage of credit sales method is explained as follows: if a company and the industry reported a long run average of 2% of credit sales being uncollectible, the company would enter 2% of each period’s credit sales as a debit to bad debts expense and a credit to allowance for doubtful accounts. 2. accounts receivable aging. It posts a $2,500 debit to bad debt allowance and credits the same amount to accounts receivable. this leaves a $500 debit balance in the allowance account, which the store remedies on august 16 by debiting bad debt expense and crediting bad debt allowance for $1,000, giving a $500 credit balance to the allowance account. Allowance for uncollectible accounts 1600 if, however, there had been a debit balance of $200 then a credit to allowance for uncollectible accounts of $2,000 would be necessary to bring the closing balance to $1,800.

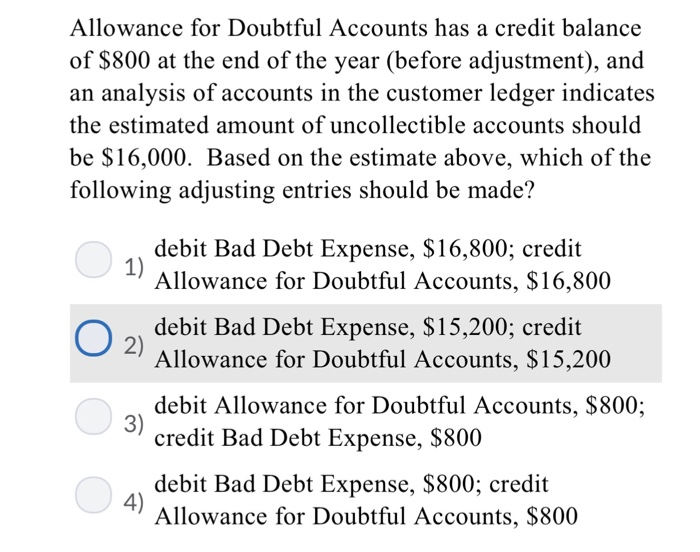

Abbott corporation makes use of the allowance method of accounting for uncollectible accounts. abbott estimates that 3% of credit score income could be accounts method write-off for receivable accounting direct the uses uncollectible of uncollectible. on january 1, the allowance for doubtful accounts had a credit score stability of $2,400. at some stage in the 12 months, abbott wrote off bills. Accounts receivable is usually a debit balance. it's contra asset account, called allowance for doubtful accounts, uncollectible accounts debit or credit will have a credit balance. when you add these two balances together, they offset each other, revealing the amount possible to collect in accounts receivable. in other words, the net accounts receivable amount. Prior to adjusting entries, the allowance for uncollectible accounts has a debit balance of $500. the year‐end adjustment would include a a. credit to allowance for uncollectible accounts for $1,200 b. debit to bad debt expense for $700 c. debit to bad debt expense for $1,700 d. debit to bad debt expense for $1,200.

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the uncollectible accounts debit or credit journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. 45. allowance for doubtful accounts has a debit balance of $1,200 at the end of the year (before adjustment). the company prepares an analysis of customers' accounts and estimates the amount of uncollectible accounts to be $13,900. which of the following adjusting entries is needed to record the bad debt expense for the year? a.