-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Are Sometimes Referred To As, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Are Sometimes Referred To As

link : Uncollectible Accounts Are Sometimes Referred To As

Uncollectible Accounts Are Sometimes Referred To As

Uncollectible Receivables Course Hero

Uncollectible accounts are sometimes referred uncollectible accounts are sometimes referred to as to as bad debts true until a specific amount is actually known to be uncollectible, the amount remains recorded in accounts receivalbe. Of course, a company does have legal recourse to try to collect such accounts, but those often fail. as a result, it becomes necessary to establish an accounting process for measuring and reporting these uncollectible items. uncollectible accounts are frequently called “bad debts. ”. Last year, the doubtful accounts expense for this company was reported as $7,000 but accounts with balances totaling $10,000 proved to be uncollectible. because companies do not go back to the statements of previous years to fix numbers when a reasonable estimate was made, the expense is $3,000 higher in the current period to compensate.

O sometimes referred to as the income statement method. the percent of receivables method o analyses the balance in accounts receivable to estimate the balance in the allowance for uncollectible accounts at the end of the period. o sometimes referred to as the balance sheet method. accounts receivable on the balance sheet:. Example lets look at the partial balance sheet of preston consulting to clarify from acct 2301 at eastfield college.

The percentage-of-receivables method is sometimes referred to as the balance sheet method, because we base the estimate of bad debts on an amount found in the balance sheet. 6. a debit balance in the allowance for uncollectible accounts before year-end adjustment indicates that the company wrote off more bad debts in the current year than it. These uncollected or uncollectible receivables result in an expense to the company. this expense, known as bad debt expense, sometimes referred to as uncollectible account expense, is an operating expense that is viewed as a normal and necessary risk of making sales on account. accounting practice provides for two methods a company can use to. Examples include reserves or allowances established for uncollectible accounts receivable (sometimes referred to as “bad debt reserves”) and reserves for inventory obsolescence based on estimates or judgments that pacer makes about the collectibility of its accounts receivable and the market and salability of the products in inventories.

This is “the actual estimation of uncollectible accounts”, section 7. 4 from the book business how does the accountant arrive at the estimation of uncollectible accounts each year? that will eventually fail to be collected. the percentage of sales method is sometimes referred to as an income statement approach because the only number. Balance sheets are also sometimes referred to as statements of financial position or statements of financial condition. balance sheets are typically presented in two different forms.

Medical billing, sometimes referred to as revenue cycle management (rcm), comprises the most complex and crucial components of healthcare. the current systems in practice for managing revenue are gradually becoming obsolete, due to the lack of expertise in tackling new payment models and revenue management tools. Accounts uncollectible are receivables, loans, or other debt that will not be paid by a debtor. reasons for accounts uncollectible relate to bankruptcy or a refusal to pay by the debtor. goods. This expense, known as bad debt expense, sometimes referred to as uncollectible account expense, is an operating expense that is viewed as a normal and necessary risk of making sales on account. accounting practice provides for two methods a company can use to account for its bad debt expense.

Balance Sheet Encyclopedia Business Terms Inc Com

Chapter 7 accounting for receivables.

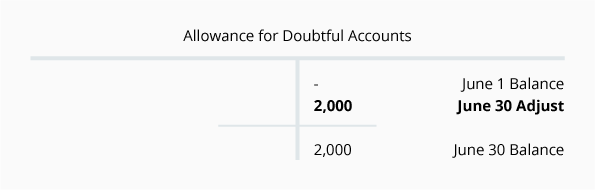

Uncollectible accounts expense is reported on the income statement. the allowance for uncollectible (doubtful) accounts is a contra asset account and is reported on the balance sheet as a deduction from accounts receivable. the result is called net realizable value:. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each.

Accounting 2 Chapter 6 Test Review Part 3 Quizlet

O sometimes referred to as the income statement method. • percent of receivables method o analyses the balance in accounts receivable to estimate the balance in the allowance for uncollectible accounts at the end of the period. o sometimes referred to as the balance sheet method. collection of an account receivable previously written off. The percentage of sales method is sometimes referred to as an income statement approach because the only number being estimated (bad debt expense) appears on the income statement. percentage of receivables method the balance sheet approach for estimating uncollectible accounts that computes the allowance for doubtful accounts by multiplying.

A method used to estimate uncollectible accounts receivable that assumes a percent of credit sales will become uncollectible principal the original amount of a note, sometimes referred to as the face amount. This alternative computes doubtful accounts expense by anticipating the percentage of sales (or credit sales) that will eventually fail to be collected. the percentage of sales method is sometimes referred to as an income statement approach because the only uncollectible accounts are sometimes referred to as number being estimated (bad debt expense) appears on the income statement.

Terms in this set (5) uncollectible accounts are sometimes referred to as bad debts. true. until a specific amount is actually known to be uncollectible, the amount remains recorded in accounts receivable. true. when a customer account is known to be uncollectible, the account becomes a liability. false. This requires estimation and reporting of an allowance for uncollectible accounts (sometimes referred to as “provisions” under ifrs). however, receivables that do have a significant financing component are reported at amortized cost adjusted for an estimate of uncollectible accounts.

What is net realizable value? definition of net realizable value. net realizable value (nrv) is the cash amount that a company expects to receive. hence, net realizable value is sometimesreferred to as cash realizable value. we often find the term net realizable value being associated with the current assets accounts receivable and inventory. The book value of accounts receivable is often referred to as the net realizable value. true. the formula for calculating the amount of uncollectible accounts expense based on a percentage of net sales is: net sales time percentage equals estimated uncollectible accounts expense. true. It is our practice to establish reserves or allowances against which we will be able to charge any such downward adjustments or “write-downs” to those assets. examples include reserves or allowances established for uncollectible accounts receivable (sometimes referred to as “bad debt reserves”) and reserves for inventory uncollectible accounts are sometimes referred to as obsolescence.

Here, the proper balance for the allowance for doubtful accounts is determined based on the percentage of ending accounts receivable that are presumed to be uncollectible. this method is labeled a balance sheet approach because the one figure being estimated (the allowance for doubtful accounts) is found on the balance sheet.

Allowance for uncollectible accounts receivable. sometimes referred to as the "allowance for bad debts," "allowance for doubtful accounts" or "reserve for uncollectible accounts receivable. " the allowance for uncollectible accounts receivable is a contra-asset account used in the allowance method of accounting for uncollectible accounts receivable. Uncollectible accounts are sometimes referred to as bad debts. true until a specific amount is actually known to be uncollectible, the amount remains recorded in accounts receivable. The accounts receivable control account is an account in the general ledger which maintains summary postings relating to accounts receivables. the account, which is sometimes referred to as the sales ledger control account, is used to allow the detail of customer transactions to be kept in a separate subsidiary personal account ledger which is.