-Hallo friends, Accounting Methods, in the article you read this time with the title Estimated Uncollectible Accounts Debit Or Credit, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Estimated Uncollectible Accounts Debit Or Credit

link : Estimated Uncollectible Accounts Debit Or Credit

Estimated Uncollectible Accounts Debit Or Credit

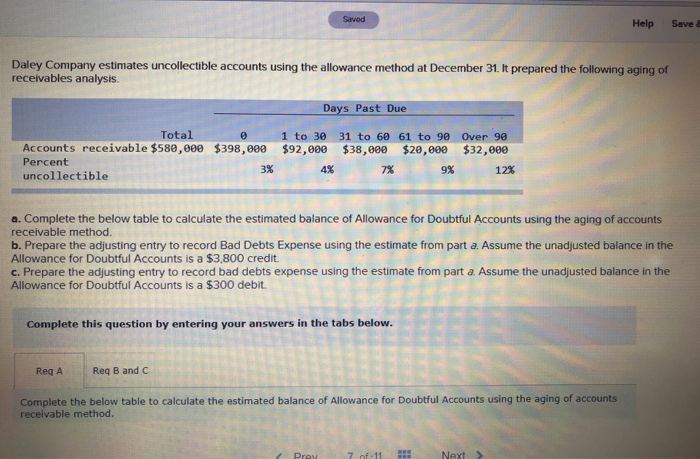

On december 31, 20×1, entity b had $250,000 balance of accounts receivable. it is estimated that 2% of accounts receivable balance may be uncollectible. before this journal entry, entity b had estimated uncollectible accounts debit or credit a credit balance of $1,600 in the allowance for doubtful accounts. prepare a journal entry to record the amount that may be uncollectible. The account 'allowance for uncollectible accounts' is a credit account. it is a contra account to the accounts receivables and is deducted from the accounts receivable to report net receivables. An aging of a company's accounts receivable indicates that $9000 are estimated to be uncollectible. if allowance for doubtful accounts has a $3200 credit balance, the adjustment to record bad debts for the period will require a.

Writing Off An Account Under The Allowance Method

Ch 8 Quizstudy 7 Flashcards Quizlet

Bad debt expense = (accounts receivable ending balance x percentage estimated as uncollectible) existing credit balance in allowance for doubtful accounts or + existing debit balance in allowance for doubtful accounts. using the same information as before, rankin makes an estimate of uncollectible accounts at the end of the year. In order to properly account for uncollectible accounts receivable, companies reduce their resources and sources of resources for estimated uncollectible accounts receivable. for example, if a company with $50,000 of january credit sales estimates that 1. 5% of such sales will not be collected, it would be affected as follows. Cr. allowance for doubtful accounts $50,000. so we have a credit balance in the account, just as we'd expect. now, when the company determines a specific receivable to be uncollectible, they 'write it off' against their allowance by recording the following entry: dr. allowance for doubtful accounts $10,000 (just an example) cr. accounts.

The remaining accounts receivable on january 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (hint: use the january 31 accounts receivable balance calculated in the general ledger. ) record the adjusting entry for uncollectible accounts. note: enter debits before credits. debit date general journal credit bad. Using the percentage of sales method, they estimated that 1% of their credit estimated uncollectible accounts debit or credit sales would be uncollectible. as you can see, $10,000 ($1,000,000 * 0. 01) is determined to be the bad debt expense that management estimates to incur.

Chapter 9 Acct Multiple Choice Flashcards Quizlet

Debituncollectibleaccounts expense; credit accounts receivable. allowance for doubtful accounts has a credit balance of $500 at the end of the year (before adjustment) and uncollectible accounts expense is estimated at 3% of net sales. if net sales are $600,000, the amount of the adjusting entry to record the provision for doubtful accounts. Illeo, inc. had credit sales for the period of $85,000. the balance in allowance for doubtful accounts is a debit of $857. what is the credit to allowance for doubtful accounts if illeo uses the aging method to estimate uncollectible accounts and an aging of accounts receivable reflected an estimated amount of uncollectible accounts of $6,382?. An aging of a company's accounts receivable indicates $10600 is estimated to be uncollectible. the company has a $1500 debit balance in its allowance for doccounts. the sent to record estimated credit losses for the period will require an) o $9100 debit to bad debt expense.

Accounting For Uncollectible Accounts Receivable Part 1

D. debit to loss on credit sales revenue and a credit to accounts receivable. 16. an aging of a company's accounts receivable indicates estimated uncollectible accounts debit or credit that $6,000 are estimated to be uncollectible. if allowance for doubtful accounts has a $800 credit balance. the adjustment to record bad debts for the period will require a a. debit to bad debt expense for. Debit allowance for doubtful accounts and credit accounts receivable an aging of a company's accounts receivable indicates that estimate of the uncollectible accounts totals $4,383. if allowance for doubtful accounts has a $1,276 credit balance, the adjustment to record the bad debt expense for the period will require a.

Debit: increase in bad debts expeense credit: increase in allowance for doubtful accounts the estimated amount of accounts receivable that is expected to be uncollectible is recorded in the allowance for doubtful accounts. this method is called as an allowance method. ©. An aging of a company's accounts receivable estimated uncollectible accounts debit or credit indicates that $14,000 are estimated to be uncollectible. if the allowance for doubtful accounts has a $1,100 credit balance, the adjustment to record bad debts for the period will require a a. debit to bad debt expense for $14,000 b. debit to bad debt expense for $12,900.

Bad debts expense a. k. a. doubtful accounts expense: an expense account; hence, it is presented in the income statement. it represents the estimated uncollectible amount for credit sales/revenues made during the period. allowance for bad debts a. k. a. allowance for doubtful accounts: a balance sheet account that represents the total estimated amount that the company will not be able to collect. Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 $1,200) in the allowance for doubtful accounts.

The percentage of credit sales method is explained as follows: if a company and the industry reported a long run average of 2% of credit sales being uncollectible, the company would enter 2% of each period’s credit sales as a debit to bad debts expense and a credit to allowance for doubtful accounts. 2. accounts receivable aging. Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. for example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for.

Debit to cash credit to accounts receivable. the ___ method of accounting for bad debts matches the estimated loss from uncollectible accounts receivables against the sales they helped produce. allowance. ace company sells merchandise to a customer in the amount of $200 on credit, terms n/30. the entry to record this sale would include a debit. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). Companies estimate uncollectible accounts receivable. debit bad debts expense and credit allowance for doubtful accounts (a contra-asset account). companies debit allowance for doubtful accounts and credit accounts receivable at the time the specific account is written off as uncollectible.

The center has the following balances on december 31, 2015, before any adjustment: accounts receivable = $110,000; allowance for uncollectible accounts = $4,000 (debit). the center estimates uncollectible accounts based on an aging of accounts receivable as shown below. age group amount receivable estimated percent uncollectible not yet due. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries:. Debit uncollectible accounts expense, $14,200; credit allowance for doubtful accounts, $14,200. allowance for doubtful accounts has a debit balance of $500 at the end of the year (before adjustments), and the uncollectible accounts expense is estimated at 3% of net sales. The company would simply take the estimated bad debt and debit the amount to the uncollectible accounts expense and credit the allowance for uncollectible accounts. for example, assume that the company estimated that it would not be able to collect $10,000 owed for the current year; the journal entry would look like this:.