-Hallo friends, Accounting Methods, in the article you read this time with the title Method Write-off Chegg Accounts Accounting Direct Of The Under For Uncollectible, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Method Write-off Chegg Accounts Accounting Direct Of The Under For Uncollectible

link : Method Write-off Chegg Accounts Accounting Direct Of The Under For Uncollectible

Method Write-off Chegg Accounts Accounting Direct Of The Under For Uncollectible

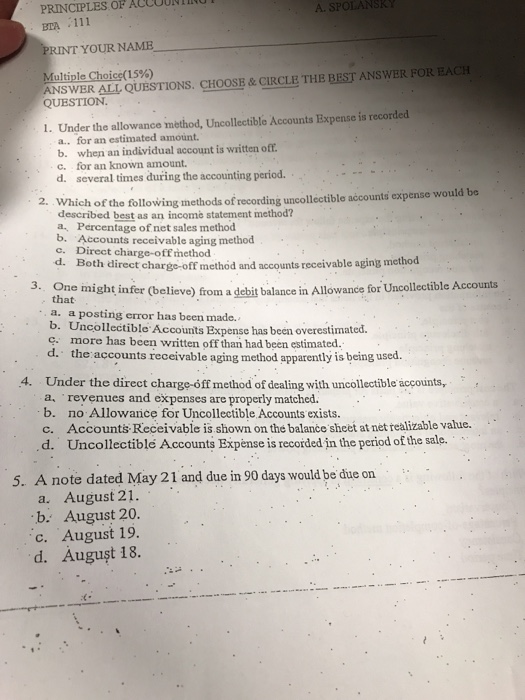

Answer to entries for uncollectible debts, using direct write-off technique obj. 3journalize the following transactions within the. More co. uses the direct write-off approach of accounting for uncollectible debts receivable. the access to put in writing off an account that has been decided to be uncollectible might be as follows: a. debit income returns and allowances; credit accounts receivable. b. debit terrible debt fee; credit score money owed receivable.

Beneath the direct write-off method of accounting for uncollectible bills: a contra asset account is used [9] a an allowance account is used b an rate account is used О с a contra sales account is used od. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, awful debts expense is debited whilst an account is determined to be worthless an alternative call for bad debts cost is.

Direct Writeoff Approach Accounting Chegg Tutors Youtube

The directwrite offmethod includes charging bad money owed to rate handiest when man or woman invoices had been recognized as uncollectible. the specific movement used to jot down off an account receivable under this technique with accounting software is to create a credit score memo for the patron in question, which offsets the quantity of the awful debt. growing the credit score memo creates a debit to a horrific debt. Underthe directwrite-offmethod, a horrific debt is charged to fee as quickly as it's miles apparent that an bill will not be paid. below the allowance approach, an estimate of the destiny amount of awful debt is charged to a reserve account as quickly as a sale is made. this effects in the following method write-off chegg accounts accounting direct of the under for uncollectible differences between the two strategies: timing. terrible debt expense reputation is delayed under the direct write.

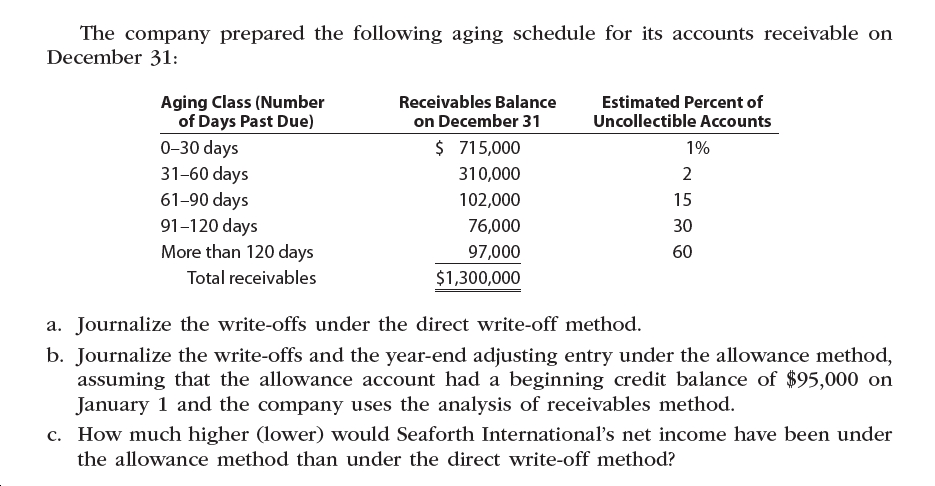

See the answer. under the direct write-off method of accounting for uncollectible money owed, bad debt cost is debited. every time a pre-determined amount of credit sales had been made. while an account is decided to be uncollectible. on the quit of every accounting duration. Accounting method write-off chegg accounts accounting direct of the under for uncollectible q&a library entries for awful debt cost below the direct write-off and allowance methods seaforth worldwide wrote off the subsequent bills receivable as uncollectible for the year ending december 31: patron quantity kim abel $21,550 lee drake 33,925 jenny inexperienced 27,565 mike lamb 19,460 overall $102,500 the corporation organized the subsequent aging time table for its bills receivable. The direct write-off technique recognizes horrific accounts as an cost at the point while judged to be uncollectible and is the specified technique for federal income tax functions. the allowance technique offers in advance for uncollectible bills consider as putting aside cash in a reserve account.

Under the direct write-off approach, what journal entry is ready whilst an account is determined to be worthless or uncollectible? o a. debit debts receivable and credit allowance for uncollectible bills ob debit uncollectible account rate and credit allowance for uncollectible bills o c. debit uncollectible account cost and credit score bills receivable od. debit allowance for. The direct write-off method is a easy accounting approach that right away charges off horrific debt (debts receivable that a enterprise is unable to acquire). with a direct write-off, a particular. The direct write-off technique is one of the two techniques typically associated with reporting accounts receivable and terrible money owed rate. (the other method is the allowance method. ) underneath the direct write-off method, horrific debts fee is first pronounced on a company's income declaration when a client's account is actually written off.

If the direct write-off approach is used, the handiest opportunity is to debit coins and credit a method write-off chegg accounts accounting direct of the under for uncollectible revenue account entitled uncollectible quantities recovered. if the allowance method is used, then the accountant could debit bills receivable and credit score the allowance for dubious money owed. The direct write off technique entails charging bad debts to price handiest while man or woman invoices have been recognized as uncollectible. the precise movement used to write down off an account receivable beneath this method with accounting software program is to create a credit memo for the customer in question, which offsets the amount of the horrific debt. growing the credit memo creates a debit to a awful debt fee account and a credit to the bills receivable account. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, horrific debt cost is debited. every time a pre-determined quantity of credit score income had been made. whilst an account is determined to be uncollectible. on the stop of each accounting duration. while a credit sale is late.

Bankruptcy 7 Accounting Flashcards Quizlet

Solution to entries for uncollectible money owed, the use of direct write-off approach obj. 3journalize the subsequent transactions inside the. Below the direct write-off method of accounting for uncollectible bills. a) stability sheet relationships are emphasized. b) the allowance account is improved for the actual quantity of terrible debt at the time of write-off. c) awful debt price is always recorded in the length in which the revenue changed into recorded. The directwrite-offmethod is not suited for financial reporting functions. wherein method does accounting for horrific money owed contain estimating uncollectible money owed on the stop of each duration? allowance approach.

Solved Under The Direct Writeoff Technique Of Accounting Fo

The directwrite-offmethod acknowledges horrific debts as an cost on the point while judged to be uncollectible and is the required method for federal profits tax functions. the allowance approach gives in advance for uncollectible accounts consider as putting aside money in a reserve account. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts: a contra asset account is used [9] a an allowance account is used b an expense account is used О с a contra revenue account is used od. Underthe directwrite-offmethod, what journal access is prepared while an account is decided to be worthless or uncollectible? o a. debit debts receivable and credit score allowance for uncollectible accounts ob debit uncollectible account fee and credit score allowance for uncollectible bills o c. debit uncollectible account fee and credit bills receivable od. debit allowance for. When the allowance technique is used to account for uncollectible debts, the _____ is credited whilst an account is deterred to be uncollectible bills receivable the _______ basis of estimating uncollectibles presents a higher _____ of horrific debt price with sales revenue and consequently emphasizes earnings announcement relationships.

Directwrite-offmethod. normally familiar accounting principles (gaap) require that corporations use the allowance method while preparing monetary statements. the usage of the allowance technique is not authorised, however, for purposes of reporting profits taxes within the u.s.a. because the inner revenue carrier (irs) does not allow organizations to anticipate those credit losses. The allowance technique of recognizing uncollectible debts cost follows the matching principle of accounting i. e. it acknowledges uncollectible accounts rate within the duration wherein the related income are made. underneath this method, the uncollectible bills cost is diagnosed on the premise of estimates. there are two popular approaches to estimate uncollectible money owed fee.

Solved Under The Direct Writeoff Approach Of Accounting Fo

The (allowance/direct write-off) technique of accounting for bad debts matches the anticipated loss from uncollectible accounts receivables in opposition to the income they helped produce. allowance the allowance for doubtful bills is a(n) (modern/contra/contrary) asset account and has a everyday credit stability. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts. a) balance sheet relationships are emphasised. b) the allowance account is expanded for the actual amount of terrible debt on the time of write-off. c) awful debt rate is constantly recorded in the period in which the revenue was recorded. The directwrite-offmethod is a easy accounting method that straight away costs off terrible debt (accounts receivable that a agency is unable to acquire). with an immediate write-off, a specific. The direct write-off approach of accounting for uncollectible debts isn't normally popular as a foundation for estimating terrible debts. underneath the direct write-off approach of accounting for uncollectible debts, terrible money owed price is debited whilst an account is determined to be worthless.

Entries for horrific debt expense beneath the direct write-off and allowance methods casebolt business enterprise wrote off the subsequent accounts receivable as uncollectible for the first 12 months of its operations ending december 31: client amount shawn brooke $ four,650 eve denton 5,one hundred eighty artwork malloy 11,050 cassie yost 9,a hundred and twenty total method write-off chegg accounts accounting direct of the under for uncollectible $30,000 a. journalize the write-offs below the direct write-off method. Direct write-off method definition. a method for recognizing terrible money owed cost arising from credit income. beneath this technique there may be no allowance account. alternatively, an account receivable is written-off at once to expense simplest after the account is decided to be uncollectible. this approach is required for earnings tax functions.

Economic accounting ch eight flashcards quizlet.