-Hallo friends, Accounting Methods, in the article you read this time with the title For Uncollectible Accounts The Uses Write-off Of Method Accounting Direct, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : For Uncollectible Accounts The Uses Write-off Of Method Accounting Direct

link : For Uncollectible Accounts The Uses Write-off Of Method Accounting Direct

For Uncollectible Accounts The Uses Write-off Of Method Accounting Direct

Intro to the allowance method and uncollectible accounts (monetary accounting academic forty one) ageing method for estimating uncollectible money owed ch. 9 video 1 direct write-off for uncollectible accounts the uses write-off of method accounting direct and % of. Abbott agency makes use of the allowance method of accounting for uncollectible money owed. abbott estimates that three% of credit score sales could be uncollectible. on january 1, the allowance for dubious accounts had a credit stability of $2,four hundred. throughout the yr, abbott wrote off money owed receivable totaling $1,800 and made credit sales of $a hundred,000. Journalize the subsequent transactions inside the money owed of champion clinical co. a scientific equipment company that makes use of the direct write-off technique of accounting for uncollectible receivables: jan. 19. offered products on account to dr. dale van dyken, $30,000.

Intro To The Allowance Approach And Uncollectible Debts

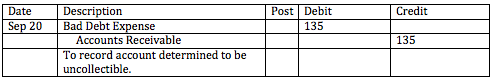

The direct write off method includes charging awful money owed to rate handiest when person invoices were diagnosed as uncollectible. the unique movement used to write off an account receivable beneath this method with accounting software program is to create a credit memo for the consumer in query, which offsets the amount of the awful debt. developing the credit memo creates a debit to a horrific debt rate account and a credit score to the money owed receivable account. Gideon organisation uses the direct write-off approach of accounting for uncollectible bills. on might also three, the gideon corporation wrote off the $2,000 uncollectible account of its customer, a. hopkins. the entry or entries gideon makes to document the write off of the account on may 3 is:. The direct write-off method is one of the two strategies normally associated with reporting debts receivable and bad debts rate. (the other approach is the allowance method. ) underneath the direct write-off approach, horrific money owed price is first pronounced on a corporation's earnings announcement while a customer's account is absolutely written off.

The directwrite offmethod includes charging awful money owed to cost best when character invoices were identified as uncollectible. the precise motion used to put in writing off an account receivable under this technique with accounting software is to create a credit score memo for the consumer in query, which offsets the quantity of the terrible debt. growing the credit memo creates a debit to a horrific debt. The lowery co. makes use of the direct write-off approach of accounting for uncollectible accounts receivable. lowery has a client whose accounts receivable balance has been determined to probable be uncollectible. the access to write off this account might be which of the subsequent? :.

Writing off horrific money owed money owed receivable youtube.

Accounting For Uncollectible Receivables

The directmethod mainly refers back to the direct write-off out of the whole money owed receivable when sure debts had been deemed uncollectible. the quantity of a write-off for the uncollectible debts receivable is for this reason a horrific debt price to a organization. below the direct method, on the time of the credit income, a enterprise assumes that all. Directwrite-offmethod. a simple technique to account for uncollectible bills is the direct write-off method. beneath this technique, a selected account receivable is eliminated from the accounting records at the time it is sooner or later decided to be uncollectible. the right entry for the direct write-off method is as follows:. Corporations use two methods for managing uncollectible bills. the direct write-off method acknowledges awful accounts as an fee on the factor when judged to be uncollectible and is the specified approach for federal earnings tax functions. the allowance method presents in advance for uncollectible accounts consider as placing apart for uncollectible accounts the uses write-off of method accounting direct money in a reserve account. the allowance technique represents the accrual basis of accounting and is the regularly occurring method to record uncollectible debts for monetary. This video discusses the accounting used when debts receivable move awful and must be written off. (allowance method, direct write off) growing older technique for estimating uncollectible accounts.

The Direct Write Off Technique The Way To Cope With Awful Money Owed In

When is it suitable to use the direct write-off approach of accounting for uncollectible accounts? one technique conforms to gaap and the other typically does no longer, one approach reviews internet realizable fee on the stability sheet and the alternative does no longer, and one approach requires the estimation of uncollectible debts and the alternative does no longer. Direct write-off method. a easy approach to account for uncollectible debts is the direct write-off method. below this technique, a selected account receivable is eliminated from the accounting statistics on the time it's far finally decided to be uncollectible. the perfect access for the direct write-off technique is as follows:. Underneath direct write-off technique the uncollectible money owed expense is diagnosed whilst a receivable is absolutely decided to be uncollectible. unlike allowance method, no valuation allowance is used and debts receivables are reported inside the balance sheet at gross quantity.. this technique does not observe the matching precept of accounting because no attempt is made to suit income sales with.

The direct write off method is a way agencies account for debt can’t be gathered from customers, in which the awful money owed cost account is debited and money owed receivable is credited. for instance, a graphic dressmaker makes a brand new logo for a consumer and sends the documents with an invoice for $500, however the customer by no means can pay and the dressmaker comes to a decision the client received’t ever pay, so she debits horrific debts. Gideon business enterprise uses the direct write-off technique of accounting for uncollectible bills. on may also 3, the gideon employer wrote off the $2,000 uncollectible account of its customer, a. hopkins. the access or entries gideon makes to report the write off of the account on may also three is: terrible debt cost (debit $2,000).

Ch 8 Acct Flashcards Quizlet

When evaluating the direct write-off method and the allowance technique of accounting for uncollectible receivables, a chief distinction is that the direct write-off technique a. uses an allowance account. The lmn co. uses the direct write-off technique of accounting for uncollectible money owed receivable. the entry to jot down off an account that has been determined to be uncollectible would be as follows: debit uncollectible accounts fee; credit score bills receivable. When is it desirable to use the direct write-off approach of accounting for uncollectible bills? one method conforms to gaap and the opposite normally does not, one method reports internet realizable cost at the balance sheet and the other does not, and one technique requires the estimation of uncollectible money owed and the other does now not.

Directwrite-offmethod. normally usual accounting concepts (gaap) require that organizations use the allowance approach when preparing financial statements. the use of the allowance technique is not accepted, however, for purposes of reporting income taxes inside the u.s.a. because the internal sales carrier (irs) does now not permit businesses to expect those credit score losses. Groups account for uncollectible money owed the use of methods the direct write-off approach and the allowance method. direct write-off technique businesses use the direct write-off technique once they decide there is no chance of receiving the cash that a patron owes. The directwrite-offmethod acknowledges awful accounts as an price on the point while judged to be uncollectible and is the specified method for federal profits tax functions. the allowance technique presents earlier for uncollectible bills think about as setting apart cash in a reserve account.

Accounting 8 And Nine Flashcards Quizlet

Greater co. makes use of the direct write-off technique of accounting for uncollectible accounts receivable. the access to jot down off an account that has been decided to be uncollectible would encompass a debit to terrible debt price and a credit to debts receivable. Sixty six. if the direct write-off approach of accounting for uncollectible receivables is used, what general ledger account is debited to put in writing off a purchaser's account as uncollectible? a. uncollectible debts receivable b. money owed receivable c. allowance for dubious accounts d. horrific debt fee solution: d difficulty: clean bloom’s: remembering getting to know targets: acct. ward. for uncollectible accounts the uses write-off of method accounting direct 16. 09-03 09-03. The direct write-off method of accounting for uncollectible debts isn't always typically generic as a basis for estimating awful debts. under the direct write-off method of accounting for uncollectible bills, horrific debts price is debited when an account is determined to be worthless. The direct write-off method is one of the techniques usually associated with reporting money owed receivable and awful debts fee. (the opposite technique is the allowance approach. ) below the direct write-off technique, awful debts rate is first mentioned on a organization's earnings declaration while a purchaser's account is without a doubt written off.

Extra co. makes use of the direct write-off technique of accounting for uncollectible money owed receivable. the access to put in writing off an account that has been determined to be uncollectible would include a debit to awful debt rate and a credit to accounts receivable. Write-off approach vs. allowance approach. uncollected monies from credit score income can limit a organisation's coins waft. if delinquent customers fail to reply to collection efforts, accountingmethods are used to understand the loss from the sale: the allowance and the direct write-off techniques. even though each approach. The direct write off technique is one in all strategies to account for bad money owed in bookkeeping. the opposite technique is the allowance approach. a horrific debt is an amount owing that a client will now not pay. inside the direct write off method, a small enterprise owner can debit the horrific money owed expense account and credit debts receivable.