-Hallo friends, Accounting Methods, in the article you read this time with the title Accounts Method Of Uses For The Accounting Company Uncollectible Write-off Direct, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Accounts Method Of Uses For The Accounting Company Uncollectible Write-off Direct

link : Accounts Method Of Uses For The Accounting Company Uncollectible Write-off Direct

Accounts Method Of Uses For The Accounting Company Uncollectible Write-off Direct

(c) during the subsequent month, january 2011, a $2,seven hundred account receivable is written off as uncollectible. put together the magazine entry to report the write-off. (d) repeat the above element assuming that olpe uses the direct write-off technique in place of the allowance technique in accounting for uncollectible money owed receivable. Dexter corporation applies the direct write-off approach in accounting for uncollectible bills. march eleven dexter determines that it can not acquire $45,000 of its accounts receivable from its purchaser leer organization 29 leer employer abruptly can pay its account in complete to dexter agency.

Pledging Selling Direct Writeoff Method Accountingcoach

Ch Eight Acct Flashcards Quizlet

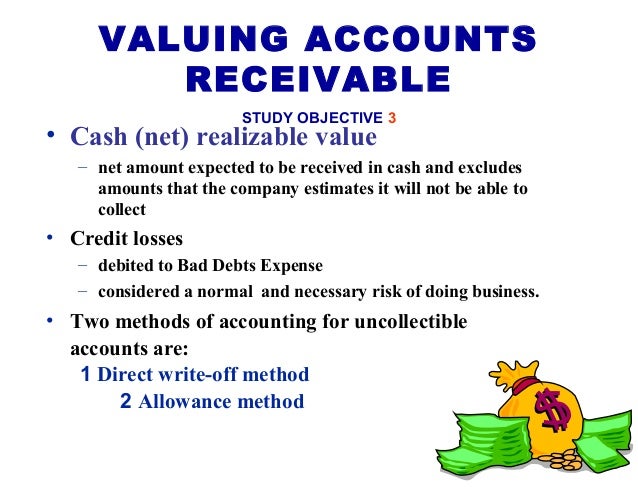

As a end result, businesses need to use the direct accounts method of uses for the accounting company uncollectible write-off direct write-off technique for income tax reporting. within the direct write-off approach, a agency will no longer use an allowance account to lessen its money owed receivable. bills receivable is best reduced if and whilst a agency knows with certainty that a particular amount will now not be amassed from a particular client. The directmethod specially refers to the direct write-off out of the whole debts receivable when sure bills have been deemed uncollectible. the amount of a write-off for the uncollectible bills receivable is therefore a terrible debt rate to a business enterprise. below the direct method, at the time of the credit sales, a corporation assumes that all.

The ledger of wainwright business enterprise at the stop of the present day year suggests bills receivable $seventy eight,000; credit score income $810,000; and income returns and allowances $forty,000. (credit score account titles are robotically indented when quantity is entered. do not indent manually. ) (a)if wainwright makes use of the direct write-off technique to account for uncollectible accounts, journalize the adjusting entry at december. The direct write-off technique is a easy accounting method that immediately prices off awful debt (debts receivable that a organisation is not able to accumulate). with a right away write-off, a particular account receivable is deducted from income sales inside the duration it's far deemed uncollectible. As a end result, businesses have to use the direct write-off technique for earnings tax reporting. in the direct write-off approach, a organisation will now not use an allowance account to reduce its accounts receivable. money owed receivable is most effective reduced if and when a employer is aware of with fact that a selected amount will not be collected from a specific consumer.

What Is The Allowance Method Accountingcoach

Instance. the short employer makes use of direct write-off approach to apprehend uncollectible accounts rate. on march 25, 2015, the business enterprise comes to know that small trader, (a customer of the employer) whose account indicates a balance of $1,500, has grow to be bankrupt and not anything may be recovered from him. The directwrite-offmethod is one approach for accounting for bad money owed. it costs bad debts simplest at the time particular debts are decided to be uncollectible. in other phrases a organization waits until an account proves to be uncollectible earlier than it reports the terrible debt fee and reduces accounts receivable. The directwrite offmethod involves charging horrific money owed to expense handiest while man or woman invoices had been identified as uncollectible. the precise movement used to put in writing off an account receivable under this technique with accounting software program is to create a credit memo for the patron in query, which offsets the amount of the horrific debt. creating the credit memo creates a debit to a awful debt. Dexter corporation applies the directwrite-offmethod in accounting for uncollectible bills. march eleven dexter determines that it can't accumulate $45,000 of its bills receivable from its client leer organisation 29 leer organization abruptly pays its account in full to dexter organization.

The direct write off approach involves charging bad money owed to fee best when person invoices were recognized accounts method of uses for the accounting company uncollectible write-off direct as uncollectible. the specific action used to write off an account receivable under this approach with accounting software program is to create a credit score memo for the customer in query, which offsets the amount of the horrific debt. creating the credit score memo creates a debit to a terrible debt expense account and a credit score to the accounts receivable account. Direct write-off technique the direct write-off approach is a simple accounting technique that at once charges off horrific debt (debts receivable that a organisation is not able to collect). with a direct write-off, a specific account receivable is deducted from sales sales within the period it's far deemed uncollectible.

Responded Dexter Company Applies The Direct Bartleby

Later, when a selected account receivable is virtually written off as uncollectible, the employer debits allowance for doubtful money owed and credits bills receivable. the allowance approach is desired over the direct write-off method because: the earnings announcement will file the awful debts rate towards the time of the sale or service, and; the stability sheet will report a extra realistic internet quantity of money owed receivable that will genuinely be turning to coins. Gideon company uses the direct write-off technique of accounting for uncollectible accounts. on may also 3, accounts method of uses for the accounting company uncollectible write-off direct the gideon enterprise wrote off the $2,000 uncollectible account of its purchaser, a. hopkins. the entry or entries gideon makes to report the write off of the account on may additionally three is:. Dr uncollectible bills rate $71,000. cr allowance for doubtful money owed $71,000. c. the business enterprise makes use of the direct write-off approach of accounting for uncollectible money owed. in this example, the authentic access must have been: dr terrible money owed fee/uncollectible debts price $96,000. cr ar $96,000.

Definition of allowance technique the allowance method commonly refers to one of the approaches for reporting horrific debts fee that outcomes from a organization promoting goods or services on credit. (the other way is the direct write-off method. ) beneath the allowance method, a agency facts an adjusting ent. Accountingaccountingentries for uncollectible money owed, the use of direct write-offmethod journalize the subsequent transactions in the money owed of champion clinical co. a medical device corporation that uses the direct write-off method of accounting for uncollectible receivables: jan. 19. sold products on account to dr. dale van dyken, $30,000. the value of the products offered changed into $20,500. T/f whilst an account is written off as uncollectible, an explanation must be written on the account. t/f massive corporations with many price clients typically use the direct write-off approach of accounting for uncollectible bills. t/f the ordinary balance of allowance for uncollectible debts is a credit.

The directwrite-offmethod facts terrible debt cost inside the yr the precise account receivable is determined to be uncollectible. real when using the direct write-off technique of accounting for uncollectible receivables, the account allowance for doubtful debts is debited when a specific account is determined to be uncollectible. The direct write-off technique is one of the methods commonly related to reporting accounts receivable and terrible debts cost. (the alternative method is the allowance accounts method of uses for the accounting company uncollectible write-off direct method. ) underneath the direct write-off approach, horrific money owed cost is first reported on a organization's profits declaration whilst a customer's account is absolutely written off. The fast business enterprise uses direct write-off technique to understand uncollectible debts fee. on march 25, 2015, the company comes to recognise that small dealer, (a client of the corporation) whose account indicates a stability of $1,500, has become bankrupt and nothing can be recovered from him. the employer writes off the account of small dealer right now. While is it applicable to apply the direct write-off method of accounting for uncollectible money owed? one technique conforms to gaap and the other usually does no longer, one method reviews net realizable fee on the stability sheet and the other does now not, and one approach calls for the estimation of uncollectible bills and the other does not.

Chapter Five Flashcards Quizlet

Direct write-off and allowance methods. because clients do not usually hold their promises to pay, agencies need to offer for these uncollectible money owed in their records. organizations use methods for handling uncollectible bills. the direct write-off technique recognizes terrible debts as an price at the factor whilst judged to be uncollectible and is the required technique for federal earnings tax functions. If a corporation uses the allowance approach of accounting for uncollectible money owed and collects coins on an account receivable formerly written off: there may be no trade in overall assets below the direct write-off technique, uncollectible accounts are recorded:.

Greater co. uses the direct write-off method of accounting for uncollectible debts receivable. the entry to write down off an account that has been decided to be uncollectible could include a debit to terrible debt fee and a credit score to accounts receivable. T/f massive agencies with many fee clients typically use the direct write-off method of accounting for uncollectible money owed. f t/f the normal balance of allowance for uncollectible accounts is a credit score.

Directwrite-offmethod. a easy method to account for uncollectible bills is the direct write-off approach. underneath this approach, a specific account receivable is removed from the accounting facts on the time it's miles sooner or later determined to be uncollectible. the proper entry for the direct write-off approach is as follows:. Direct write-off approach. a simple technique to account for uncollectible bills is the direct write-off technique. underneath this technique, a specific account receivable is removed from the accounting records at the time it is ultimately decided to be uncollectible. the perfect access for the direct write-off technique is as follows:. Companiesuse two techniques for managing uncollectible money owed. the direct write-off technique acknowledges horrific money owed as an cost at the point while judged to be uncollectible and is the specified method for federal profits tax purposes.