-Hallo friends, Accounting Methods, in the article you read this time with the title Accounting Method Books, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accounting Method Books, article posts Books, article posts Method, which we write this you can understand. Alright, happy reading.

Title : Accounting Method Books

link : Accounting Method Books

Accounting Method Books

Cash Vs Accrual Accounting Whats Best For Quickbooks

The more you prepare your accounting systems, the easier recordkeeping will be. here are five steps you can take to set up accounting books for small business. 1. choose an accounting method. when setting up an accounting system for a new company, you need to choose a method for recording transactions. (there is a requirement, however, that some businesses use a certain method of crediting their accounts: the cash method or accrual method. for more information, see nolo's article cash vs. accrual accounting. ) depending on the size of your business and amount of sales, you can create your own ledgers and reports, or rely on accounting software. Crop method: this method of accounting is available for farmers who do not harvest and sell their crops in the same year that they planted and grew them. the crop method allows the farmer to. Mar 30, 2015 · keep in mind, however, that the irs requires companies to use the same accounting method to report taxable income and keep books for the tax year. refer to irs publication 334: accounting periods and methods for additional details on irs rules regarding the use of cash accounting for your small business.

Accounting Methods Encyclopedia Business Terms Inc Com

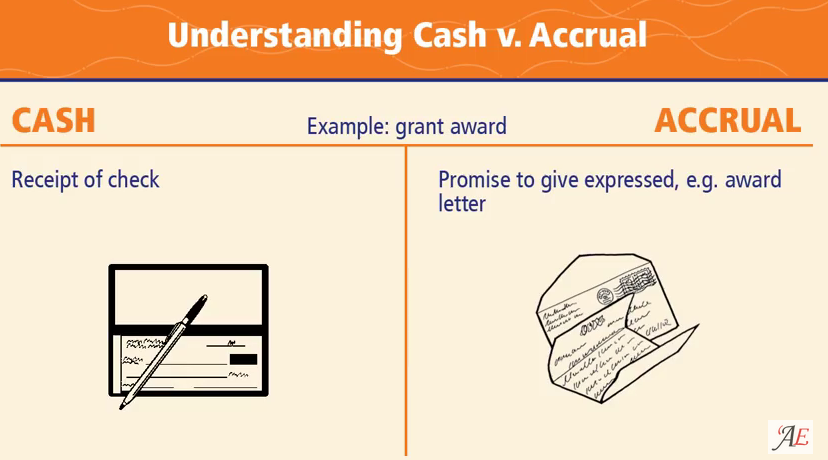

In addition to your permanent accounting books, you must keep any other records necessary to support the entries on your books and tax returns. you must use the same accounting method from year to year. an accounting method clearly reflects income only if all items of gross income and expenses are treated the same from year to year. Officially, there are two types of accounting methods, which dictate how the company’s transactions are recorded in the company’s financial books: cash-basis accounting and accrual accounting. the key difference between the two types is how the company records cash coming into and going out of the business. within that simple difference lies a lot of. Accounting methods refer to the basic rules and guidelines under which businesses keep their financial records and prepare their financial reports. there are two main accounting methods used for. From synthetic leases to inflated revenues, companies employ a variety of cooking-the-books accounting methods to mislead investors.

The business is a staffing agency and is an llc. it was started in 2015 so the tax returns for 2015 and 2016 show cash method of accounting. the returns had to be amended because the accounting books were incorrect. the 2017 is the return we want to change the accounting method. the company gross receipts were $100k in 2017 so i don't know if this is still considered a small business. Jun 04, 2019 · the business is a staffing agency and is an llc. it was started in 2015 so the tax returns for 2015 and 2016 show cash method of accounting. the returns had to be amended because the accounting books were incorrect. the 2017 is the return we want to change the accounting method. the company gross re. All businesses, whether they use the cash-basis accounting method or the accrual accounting method, use double-entry bookkeeping to keep their books. double-entry accounting is a practice that helps minimize errors and increases the chance that your books balance. this method gets its name because you enter all transactions twice.

Their tax records, on the other hand, must comply with the internal revenue code, which recognizes cash, accrual or a hybrid accounting method as valid methods of reporting. if the company is not using the same accounting method for both sets of books, the income that gets reported on their financial statement may not match the income they. What is the accrual method? accounting standards outlined by the generally accepted accounting principles (gaap) stipulate the use of accrual accounting for financial reporting, as it provides a clearer picture of a company’s overall finances. but just what is this method? with the accrual accounting method, income and expenses are recorded. Two principal methods are used when accounting for inventory for book and tax purposes. the first is the last-in, first-out (lifo) method. using this method, the cost of inputs purchased for production in a given period is matched with the revenues generated by items sold in the same period. Your financial accounting treatment of inventories is determined with regard to the method of accounting you use in your applicable financial statement accounting method books (as defined in section 451(b)(3 or, if you do not have any applicable financial statement, with regard to the method of accounting you use in your books and records that have been prepared in.

If you have more than one business, you may use a different accounting method for each as long as you maintain a complete and separate set of books for each business. changing your accounting method. to change your accounting method, you must get irs approval. file form 3115, application for change in accounting method. Definition of accounting method. it is a method, rules, guidelines suggested by the company act, how an organization will record their business transactions in the books of accounts, in other words how a company will record their income or expense in their books of accounts which is either in cash method or accrual method. Cost method overview. when an investing entity makes an investment and the investment has the following two criteria, the investor accounts for the investment using the cost method:. the investor has no substantial influence over the investee (generally considered to be an investment of accounting method books 20% or less of the shares of the investee).. the investment has no easily determinable fair value.

Although accounting standards such as gaap (generally accepted accounting principles) require the use of accrual accounting in financial reporting, many new small businesses and established organizations use cash accounting to keep their books.. the widespread adoption of cash accounting (also referred to as the “cash method”) among small businesses can be attributed to its simplicity and. May 03, 2019 · what is the accrual method? accounting standards outlined by the generally accepted accounting principles (gaap) stipulate the use of accrual accounting for financial reporting, as it provides a clearer picture of a company’s overall finances. but just what is this method? with the accrual accounting method, income and expenses are recorded. An accounting method is a set of rules under which revenues and expenses are reported in financial statements. the choice of accounting method can result in differing amounts of profit being reported in the short-term. over the long-term, the choice of accounting method has a reduced impact on profitability.

The 15 most recommended accounting books 1. accounting made simple accounting explained in 100 pages or less by mike piper. listed 8 out of 17 times, this book makes things straight and simple with practical and straightforward examples that help sheds light on the concepts without the unnecessary jargon of the technicalities. First, you must adjust your books to reflect the accrual method. you must also fill out and file a form with the irs to request the change. adjusting your books. if you decide to switch your books from cash basis to accrual, accounting method books you must adjust your records. in accrual accounting, you account for incurred income and expenses. Understanding accounting methods. officially, there are two types of accountingmethods, which dictate how the company’s transactions are recorded in the company’s financial books: cash-basis accounting and accrual accounting. the key difference between the two types is how the company records cash coming into and going out of the business. An accounting method is a set of rules under which revenues and expenses are reported in financial statements. the choice of accounting method can result in differing amounts of profit being reported in the short-term. over the long-term, the choice of accounting method has a reduced impact on profitability.. the primary accounting methods are the accrual basis of accounting and the cash basis.

Choosing an accounting method. when you can choose either method. most small businesses (with sales of less than $5 million per year) are free to adopt either accounting method. when you must use the accrual method. you must use the accrual method if: your business has sales of more than $5 million per year, or. Accrual method; other ; you select an accounting method by placing a check mark in the box that applies to you when you file schedule c. if you own more than one business. if you have more than one business, you may use a different accounting method for each as long as you maintain a complete and separate set of books for each business. Accounting firm. associations are not required to use accounting firms to keep their books but they are required to use certain accounting methods in the keeping of their books. moreover, depending on the size of their budget and/or their governing documents, they may be required to have an independent third party review or audit their books.