-Hallo friends, Accounting Methods, in the article you read this time with the title Accounting Method Amortized Cost, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accounting Method Amortized Cost, article posts Amortized, article posts Cost, article posts Method, which we write this you can understand. Alright, happy reading.

Title : Accounting Method Amortized Cost

link : Accounting Method Amortized Cost

Accounting Method Amortized Cost

Analysis Of Algorithm Set 5 Amortized Analysis

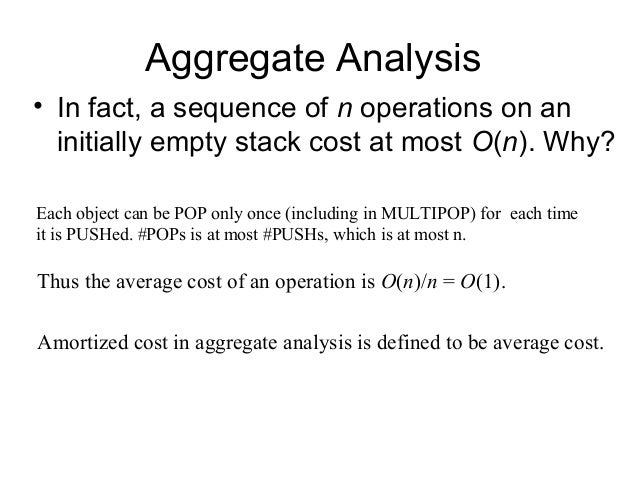

In the field of analysis of algorithms in computer science, the accounting method is a method of amortized analysis based on accounting. the accounting method often gives a more intuitive account of the amortized cost of an operation than either aggregate analysis or the potential method. note, however, that this does not guarantee such analysis will be immediately obvious; often, choosing the.

The amortized cost concept can be applied to several scenarios in the areas of accounting and finance, which are as follows: fixed assets. amortized cost is that accumulated portion of the recorded cost of a fixed asset that has been charged to expense through either depreciation or amortization. depreciation is used to ratably reduce the cost of a tangible fixed asset, and amortization is used. The accounting method is aptly named because it borrows ideas and terms from accounting. here, each operation is assigned a charge, called the amortized cost. some operations can be charged more or less than they actually cost. Amortized cost is an investment classification category and accounting method which requires financial assets classified under this method to be reported on balance sheet at their amortized cost which equals their initial acquisition amount less principal repayment plus/minus amortization of discount/premium (if any) plus/minus foreign exchange differences (if any) less impairment losses (if any).

Introduction. amortized cost falls under-investment category and method to accounting which requires financial assets under amortized cost method to be reported on balance sheet date at amortized cost which should equal to initial acquisition amount fewer deductions for principal repayment and adjustments amortization or impairment if any. The accounting method effectively charges for each operation, storing up credits so that later it can be used to pay for future operations. note that the accounting method is just a different way to perform an amortized analysis. it may not be as initially intuitive as the aggregate method, it can actually be a bit easier to understand. Lecture 21: amortized analysis. time in all, including the cost of resizing. in contrast, the accounting method seeks to find a payment of a number of extra time units charged to each individual operation such that the sum of the payments is an upper bound on the total actual cost. intuitively, one can think of maintaining a bank account.

Amortized Cost Effective Interest Rate Method Example

Amortized Analysis Wikipedia

The accounting records show the debt at the accounting method amortized cost amortized cost (face amount plus premium/less discount) and the difference between the maturity value and the cost of the bonds is amortized to the income statement over the life of the bonds. The accounting method is a form of aggregate analysis which assigns to each operation an amortized cost which may differ from its actual cost. early operations have an amortized cost higher than their actual cost, which accumulates a saved "credit" that pays for later operations having an amortized cost lower than their actual cost.

Amortizedcost is an accounting method in which all financial assets must be reported on a balance sheet at their amortized value which is equal to their acquisition total minus their principal repayments and any discounts or premiums minus any impairment losses and exchange differences. Amortized analysis is a method of analyzing the costs associated with a data structure that averages the worst operations out over time. often, a data structure has one particularly costly operation, but it doesn't get performed very often. that data structure shouldn't be labeled a costly structure just because that one operation, that is seldom performed, is costly. so, amortized.

Debt Held To Maturity Boundless Accounting

Here, we also discuss amortized analysis: a method of determining the amortized cost of an operation over a sequence of operations. amortized analysis is very often used to analyse performance of algorithms when the straightforward analysis produces unsatisfactory results, but amortized analysis helps to show that the algorithm is actually. Amortized cost, on the other hand, is the result of a formulaic process that starts with an asset's original cost and then involves adjusting it over time to accommodate for wear and tear on the asset. the remaining, adjusted value of the asset and the amortized portion of its cost is recorded in the company's financial statements. The preferred method for amortizing (or gradually writing off) a discounted bond is the effective interest rate method or the effective interest method. under this method, the amount of interest. The amortized cost of a bond applies to bonds that have been issued at a higher interest rate than its face value. these are known as discounted bonds and represent an additional cost for which the issuer has to account. the effective interest rate method is the preferred way to calculate this cost.

Amortizedcost Accountingtools

The amortized cost concept can be applied to several scenarios in the areas of accounting and finance, which are as follows: fixed assets. amortized cost is that accumulated portion of the recorded cost of a fixed asset that has been charged to for example, abc international has been depreciating. The theoretically preferable approach to recording amortization is the effective-interest method. interest expense is a constant percentage of the bond’s carrying value, rather than an equal dollar amount each year. the theoretical merit rests on the fact that the interest calculation aligns with the basis on which the bond was priced. 2) the above amortized analysis done for dynamic array example is called aggregate method. there are two more powerful ways to do amortized analysis called accounting method and potential method. we will be discussing the other two methods in separate posts. 3) the amortized analysis doesn’t involve probability. there is also another.

Amortization is an accounting method that gradually and systematically reduces the cost value of a limited-life, intangible asset. effective-interest and straight-line amortization are the two. How to calculate the amortized cost of a bond amortized cost of bonds. because interest rates fluctuate, the interest a corporation expects accounting method amortized cost to pay on a bond (its face straight-line bond amortization formula. this is the easy way to calculate an amortized cost. if a corporation issues effective.

In the field of analysis of algorithms in computer science, the accounting method is a method of amortized analysis based on accounting. the accounting method often gives a more intuitive account of the amortized cost of an operation than either aggregate analysis or the potential method. note, however, that this does not guarantee such analysis will be immediately obvious; often, choosing the correct parameters for the accounting method requires as much knowledge of the problem and the complexi. Costmethod overview. when an investing entity makes an investment and the investment has the following two criteria, the investor accounts for the investment using the cost method:. the investor has no substantial influence over the investee (generally considered to be an investment of 20% or less of the shares of the investee).. the investment has no easily determinable fair value.

The aggregate method of amortized' analysis was used by aho, hopcroft, and ullman [4]. tarjan [189] surveys the accounting and potential methods of amortized analysis and presents several applications. he attributes the accounting method to several authors, including m. r. brown, r. e. tarjan, s. huddleston, and k. mehlhorn. The effective interest method is an accounting practice accounting method amortized cost used to discount a bond. this method is used for bonds sold at a discount; the amount of the bond discount is amortized to interest expense.

Amortized cost if a business holds debt securities to maturity with the intent to sell are classified as held-to-maturity securities. held to maturity securities are reported at amortized cost less impairment. Amortization is an accounting method that gradually and systematically reduces the cost value of a limited-life, intangible asset. Amortizedcost is a concept that you will likely come across when preparing or reviewing business financial statements such as the balance sheet or income statement. market value, on the other hand, is a bit more of a broad concept that applies to different scenarios and is not always used in such a specific accounting context. Explain the difference between amortized cost, fair value and the equity method for reporting debt securities key points debt securities that the enterprise has the positive intent and ability to hold to maturity are classified as held-to-maturity securities and reported at amortized cost less impairment.