-Hallo friends, Accounting Methods, in the article you read this time with the title How to Calculate Contribution Margin, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Artikel, which we write this you can understand. Alright, happy reading.

Title : How to Calculate Contribution Margin

link : How to Calculate Contribution Margin

How to Calculate Contribution Margin

How to Calculate Contribution MarginHow to Calculate Contribution Margin - Hello Friend Accounting Methods, In the article you read this time with the title How to Calculate Contribution Margin, We have prepared this article for you to read and retrieve information therein. Hopefully the contents of postings Article management accounting, We write this you can understand. Alright, good read.

Title : How to Calculate Contribution Margin

link : How to Calculate Contribution Margin

How to Calculate Contribution Margin

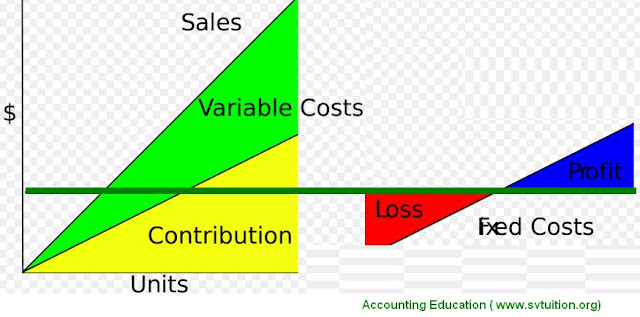

In management accounting, we can use contribution margin for evaluate any product from financial point of view. It can be simply calculated by deducting variable cost from total sale revenue of any product.

1st Step : To Calculate Sale Price of Any Product

For example, cost of price of my management accounting eBook is Rs. 1000. I will not sell one management accounting ebook from this price.

2nd Step : To Calculate Variable Cost Any Product

a) For Selling this ebook, I use payment gateway. For example, if it deduct 10% commission on per sale. For example, I produced 1000 ebooks in Jan. 2017 and sold. It means, I had received earning Rs. 10,00,000. It means, I have paid commission to payment gatway Rs. 1,00,000.

So first variable cost is Rs. 1,00,000

b) For checking order, talking with customer and sending ebook and manage queries, I have appointed employees. For example, I am paid Rs. 1,00,000 to him.

c) Other Variable Cost for doing this specific work is Rs. 1,00,000

So, variable cost per unit is = Rs. 3,00,000 / 1,000 = Rs. 300 per unit

3rd Step : Calculate Contribution Margin

Contribution Margin = Sale price per unit - Variable Cost per unit

= RS. 1,000 - Rs. 300 = Rs. 700

If our contribution margin is more than our fixed cost, it is good sign because after deducting it, we can increase our scale of profit. Because whole one month, fixed cost will not increase. If fixed cost is very high than contribution, then, we will face loss. For this, either, we need to increase our price or leave same product.

We can also calculate Contribution margin % by using following formula.

1st Step : To Calculate Sale Price of Any Product

For example, cost of price of my management accounting eBook is Rs. 1000. I will not sell one management accounting ebook from this price.

2nd Step : To Calculate Variable Cost Any Product

a) For Selling this ebook, I use payment gateway. For example, if it deduct 10% commission on per sale. For example, I produced 1000 ebooks in Jan. 2017 and sold. It means, I had received earning Rs. 10,00,000. It means, I have paid commission to payment gatway Rs. 1,00,000.

So first variable cost is Rs. 1,00,000

b) For checking order, talking with customer and sending ebook and manage queries, I have appointed employees. For example, I am paid Rs. 1,00,000 to him.

c) Other Variable Cost for doing this specific work is Rs. 1,00,000

So, variable cost per unit is = Rs. 3,00,000 / 1,000 = Rs. 300 per unit

3rd Step : Calculate Contribution Margin

Contribution Margin = Sale price per unit - Variable Cost per unit

= RS. 1,000 - Rs. 300 = Rs. 700

If our contribution margin is more than our fixed cost, it is good sign because after deducting it, we can increase our scale of profit. Because whole one month, fixed cost will not increase. If fixed cost is very high than contribution, then, we will face loss. For this, either, we need to increase our price or leave same product.

We can also calculate Contribution margin % by using following formula.

Contribution margin % = Contribution margin per unit / sale price per unit X 100

Thus Article How to Calculate Contribution Margin

that's all the article How to Calculate Contribution Margin this time, hopefully can give benefits to all of you. alright, see you in posting other articles.

You now read the article How to Calculate Contribution Margin with link address http://accountingmethode.blogspot.com/2017/02/how-to-calculate-contribution-margin.html

[ad_2]

Source link : How to Calculate Contribution Margin